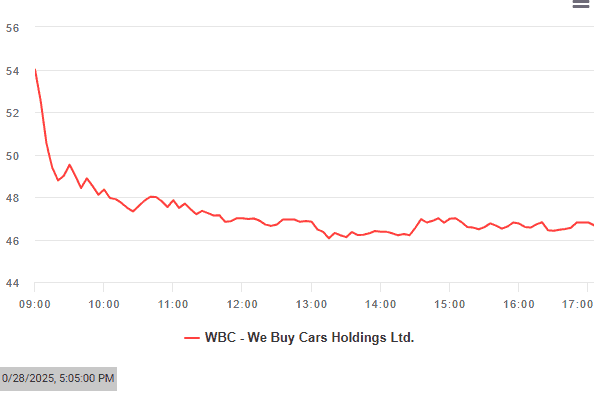

The share price of used vehicle sales giant WeBuyCars tanked around 14% on Tuesday following the release of a trading statement on the JSE in the morning.

This is despite the update flagging an up to 17% increase in core headline earnings, to R958 million, for FY2025 ending 30 September. However, core headline earnings per share (Cheps) are forecast to rise only by 0.8% to 6%, or between 219.2 cents and 230.1 cents, due to share dilution linked to capital raises.

WeBuyCars also saw slowing sales in the second half of FY2025, when one compares first-half revenue to the second half in its latest trading update.

ALSO READ: WeBuyCars plans to provide buyers with mechanical test reports

The company attributed the much lower ‘Cheps’ growth directly to the “unfavourable impact” of 83.1 million new shares issued between February and April 2024 as part of its pre-listing capital raise.

“These new shares were issued in terms of the pre-listing capital raise, which was approved by shareholders prior to the listing of WeBuyCars on the Main Board of the JSE on 11 April 2024,” it said.

“WeBuyCars utilises core headline earnings to measure and benchmark the underlying performance of the

business. Core headline earnings represent headline earnings adjusted for certain non-recurring or non-

cash items that, in the view of the group’s board of directors… may distort the financial results from period to period,” the group noted.

The group’s audited financial results for the year ended 30 September 2025 will be released on 17 November.

This article was republished from Moneyweb. Read the original here.