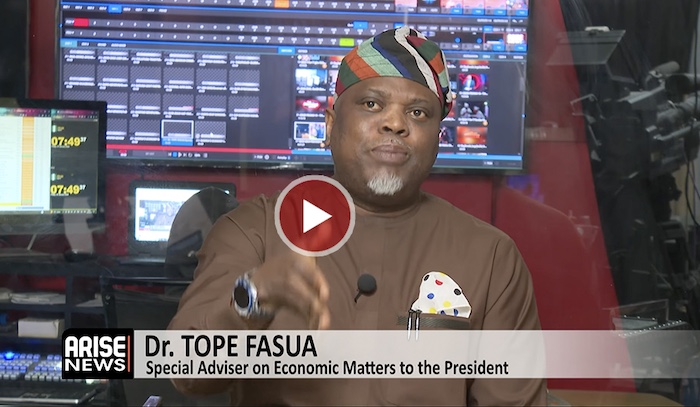

Dr. Tope Fasua, Special Adviser on Economic Matters to the President, says Tinubu’s economic and tax reforms have led to increase in workers salaries, drop in inflation and economic growth in Nigeria, while urging Nigerians to have a positive mindset towards the economic reforms.

The seasoned statistician said this in an interview with ARISE NEWS on Friday.

Fasua highlighted several areas where Nigerians have reportedly seen progress in their economic lives, staring that this is due to the President’s tax reforms in the country.

“According to the report in Business Day yesterday, 90% of workers in Nigeria have seen an increase in their take-home pay as a result of the tax reforms for January salaries alone. There are seminars going on right now to ensure that HR ensure that payees and profiles who work for every organization understand exactly what to do. Because the law is meant to reduce the burden on people who earn anything below N25M per annum. And that’s perhaps 95% of Nigerians.”

“Food prices drop but farmers will complain and say they won’t go to the farm. But this works for 95% of Nigeria, perhaps more, because most people are not farmers. Most prices are dropping, exports have increased in Nigeria, imports have reduced, naira has gotten stronger. As at yesterday, the naira got to N1,394 at the official market. And perhaps that’s the lowest we’ve seen in maybe two and half years. The reality is lives are getting a little bit better than it was. And this is a process”, he said.

He added, “farmers are complaining that the prices of things are dropping, unless you say the farmers who say they will not return to the farms are wrong. But if food prices are really dropping, then that is a key drive of our inflation. Let’s change this narrative. That’s what I’m about.”

Fasua further explained that much of Nigeria’s revenue challenge is actually about low collection, efficiency and leakages rather than citizens not paying enough

“You know these tax reforms that have been put in place, a lot of the things it tries to do is actually a multi level kind of reform. It is encompassing. It is also about getting the real data from people. The reforms will make you and I more aggressive in chasing government to ensure that the right thing is done. The new NRS, Nigeria Revenue Service, will be put under a lot of pressure to ensure that they do the collections properly. But in this country, 70% of this economy is informal, part of the reforms is to move that informal, let’s be able to get to 80% formal, if possible. We’re never going to get to a point where you have a perfect situation, and that’s it. Clearly, most people are not complying. Compliance with tax in this country is around 15%. Look at the budgeting of states now. Most states in Nigeria are not borrowing. Some of the budgets of Nigerian states are moved like 15 times. States like Enugu, Niger, Lagos state, which has moved about 5 times since 2019 to date. I’m talking of 500%. Enugu state has moved 1400%. We can see the reality of this new collection.”

Addressing whether tax harmonizing is possible soon in Nigeria especially as most Nigerians don’t understand what these taxes are, Dr Fashua explained that the ambiguity is temporary.

“The ambiguity is just a temporary thing. When you are doing something big in the beginning, there’s got to be a bit of ups and downs, hiccups and learning process. It is a very short learning process. The Senate is pushing out what has been totally agreed, and that will be published and made available through the Ministry of Information so that everybody is clear. The real issue is about payee, VAT, capital against taxes, company income, petroleum profit, it’s about the whole gamut. It is not just about the rate of these taxes, it’s also about the procedure, this is how to collect it, who will collect it, this is what you have to do. We have the most comprehensive tax review ever in this country. Because for the first time, for example, even provision for research and development for manufacturing companies have been put in place. Before, there was no provision for manufacturing companies to make deduction for research and development.”

Fashua further spoke on economic advancement plans that the government is putting in place to ensure that Nigeria is in a better place.

“Indeed, the Minister of State for Finance told me a couple of months back of certain policy that will actually accelerate disinflation by rebooting the economy at large. That is in play. Minister of Economic Planning is finalizing a Nigeria development plan, a comprehensive plan. And of course, we don’t wait for World Bank. If World Bank is 4.4%, they’ve been wrong many times before, actually. We are not looking at 4%, we are looking at at least 6, 7, 8%. We have such huge space for growth, and our people need prosperity.”

In his concluding remarks, Dr. Fasua admonished Nigerians to have a positive mindset towards the economic reforms the current government is working on.

“The thing is a few things will have to change in terms of the mindset of Nigerians. We talk about Nigeria being a very poor country and our people being perhaps the poorest in the world. But we also have habits that don’t conform with the rest of the world. I disagree with the claim that 139 million Nigerians are living below the poverty line. Multidimensional poverty is not the same as living below poverty line. It is about the access people have to facilities. Talking about the naira being at N500 to a dollar, what we did was track back in order to surge forward, and also to increase our capacity for exportation and reduce importation”, he concluded.

Favour Odima