President Cyril Ramaphosa’s announcement during his State of the Nation Address (Sona) on 12 February creates the ideal platform to define a credible end state for Eskom Holdings – and one of the big questions is around its renewable energy arm, Eskom Green.

This is clear from a new report that provides a roadmap for the implementation of South African electricity supply industry reforms that have been announced in terms of policy, but lag in delivery.

Steps to be taken by Eskom

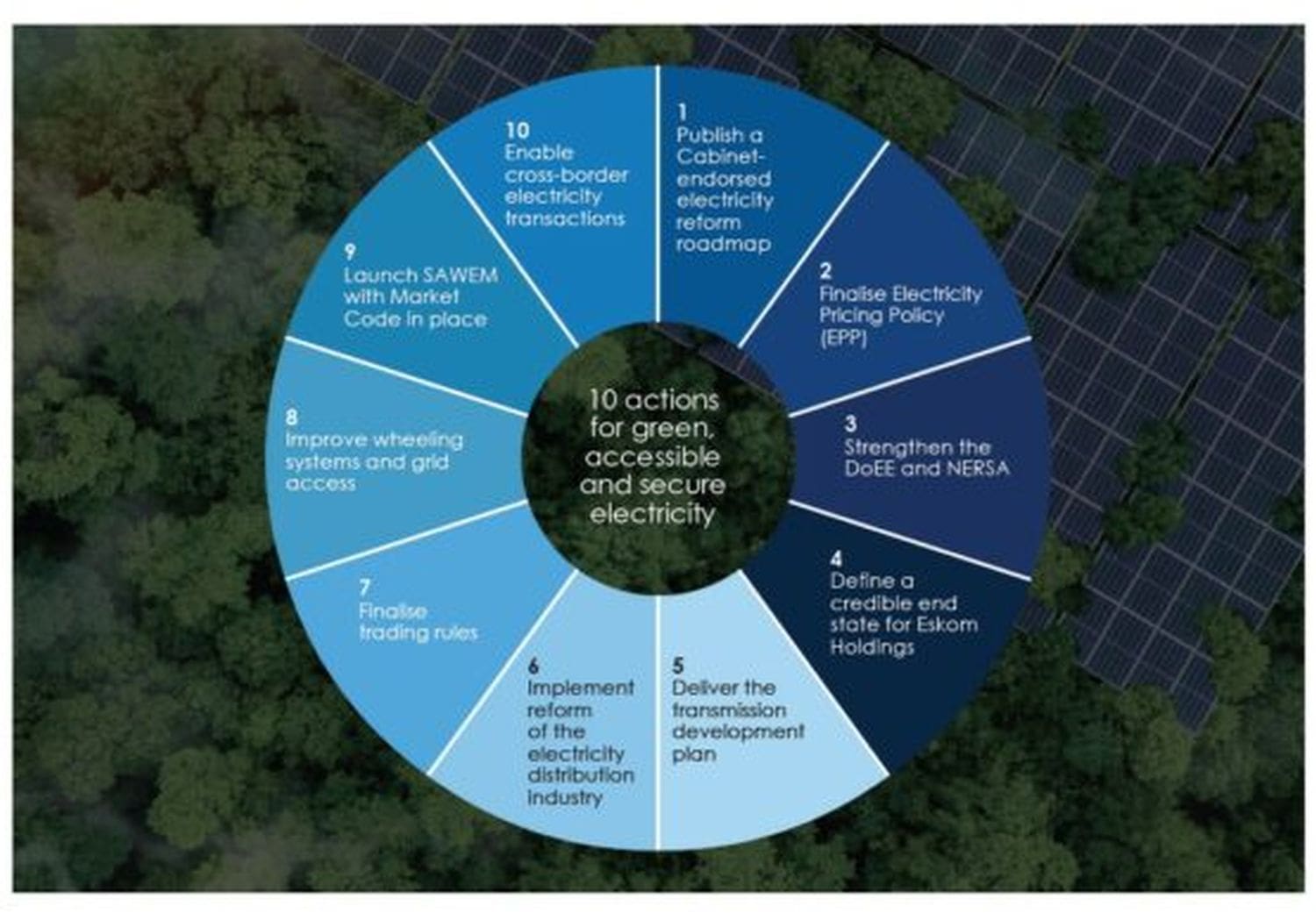

The Policy to Power report drafted by consultancy group Krutham on behalf of the South African Energy Traders Association (Saeta) sets out 10 steps that it argues must be taken immediately to realise the envisaged reforms. This includes defining a credible end state for Eskom Holdings.

Eskom announced in December that it would restructure into a holding company with four subsidiaries:

- The National Electricity Distribution Company of South Africa (Nedcsa);

- GenerationCo (GxCo);

- Eskom Green – a new subsidiary that constitutes Eskom’s renewable energy business; and

- The National Transmission Company South Africa (NTCSA) – legally separated in July 2024, formerly Eskom Transmission, which will own the transmission network.

“Additionally, a new and independent Transmission System Operator (TSO) will be established outside of Eskom,” it stated.

This plan, endorsed by Minister of Electricity and Energy Kgosientsho Ramokgopa and the Eskom board, was a departure from the roadmap announced by the late Pravin Gordhan – who at the time held the public enterprises portfolio, which included Eskom.

ALSO READ: Eskom to support task team to deliver independent TSO announced by Ramaphosa

NTCSA a separate entity

In terms of that document, the NTCSA would have been an independent company outside of Eskom that would have included ownership of the network as well as the TSO.

This deviation created a lot of uncertainty among investors and creditors.

They objected, arguing that only a completely independent NTCSA that owns and manages the network and future energy market would ensure a level playing field and successful industry reforms.

During his Sona, Ramaphosa intervened and confirmed that the original plan would be implemented.

He created a task team that will report to him every three months, with firm proposals, timelines and a phased plan to establish a fully independent transmission entity.

Eskom Green

In April last year, Eskom CEO Dan Marokane announced the establishment the group’s renewables business, later named Eskom Green.

Having dealt with load shedding, Marokane said the group is “pivoting Eskom into a sustainable and competitive company while ensuring security of supply”.

In its report, Krutham argues that the position of Eskom Green must be clarified to prevent competition distortions in the South Africa Wholesale Electricity Market (Sawem).

“While Eskom Green could play a useful role in supporting renewable energy deployment, its position within Eskom Holdings raises risks of preferential access to grid capacity, information asymmetry and cross-subsidisation,” it says.

“Clear governance, ring-fencing and regulatory oversight are required to ensure that Eskom Green operates on a fair, transparent and non-discriminatory basis, consistent with market rules that apply equally to all participants.

“Without this, Eskom Green risks undermining confidence in the neutrality of the market and deterring private investment,” according to the report.

It further states that there should be clarity on how Eskom Green will fund its projects, including confirmation that no public money will be used and a clear outline of the financial structures it plans to use to partner with the private sector.

During a virtual media event at the launch of the report, Krutham’s research manager on the Just Energy Transition Matthew le Cordeur asked if Eskom Green is “a good idea”.

ALSO READ: Eskom R254bn bailout eased financial pressure, but drained state coffers

Reform momentum not what it should be …

The report also states that reform momentum has been affected by a cautious, sequential approach in which Eskom Holdings has sought full certainty on future structures, rules and revenue before enabling new market activity.

“This linear sequencing risks delaying implementation in a reform process that requires parallel progress across institutions, market rules and participation.”

Process discipline should be no substitute for implementation, it states.

“Delays driven by sequencing preference rather than practical requirements weaken confidence and slow the early market activity needed to build liquidity, capability and trust.”

Krutham foresees that Eskom’s generation portfolio should contract over time as coal plants retire.

Roadmap required

It calls for a roadmap, endorsed by cabinet, that defines Eskom’s end state across its operations, balance sheet and functions, so that the whole of government can work towards the same goal.

The current debt relief programme must succeed if Eskom is to stabilise its balance sheet and restore access to capital markets without routine reliance on sovereign guarantees, the report states.

It also calls on National Treasury to clarify Eskom’s long-term capital structure as part of the end-state roadmap.

This article was republished from Moneyweb. Read the original here.