TFG CEO Anthony Thunström says the retailer will be adding its “weight to the calls for proper regulation” of online gambling, which is “almost entirely extractive and of no benefit to the country”. He notes the “recent Supreme Court ruling that online fixed odds gambling is illegal in South Africa”.

TFG is the third retailer, after Pick n Pay and Famous Brands, to flag concern about the rapid uptake of online betting and gaming in recent weeks.

Thunström says this “exponential growth” in online gambling is a far greater to it than the impact of Chinese e-commerce players (primarily Shein).

Speaking at the release of its interim results on Friday (7 November) Thunström said “the application of level playing field rules” where import and customs duties started being levied on smaller value parcels from November 2024 has seen Shein’s growth slow.

The owner of 39 retail brands across the clothing, homeware and furniture categories, in Africa, the UK and Australia cited data from Reveal that shows Shein’s average basket size in South Africa has dropped 30% from its April 2023 peak.

Thunström is under no illusions, admitting that Shein is a “massive global powerhouse”.

However, the 30% decline is a “really significant number and it indicates that they’re not running away [with market share]” even though “they continue to absorb overall consumer spend”. Despite this decline, Shein’s average transaction value of around R1000 remains structurally higher than that of TFG, Truworths and H&M which are all clustered around the R600 level.

ALSO READ: R1.5 trillion turnover: Online gambling snares South Africa’s youth

Holding its own

He contends that TFG has grown strongly in Shein’s “sweet spot” which is the women’s category. In the six months, turnover in this segment is up 7.5% with growth in gross profit of 8.1% (versus overall growth in the Africa business of 5.3% and a GP increase of 3.1%).

Still, Thunström says that already, online gambling amounts to 1.6% of total household spend in the country, compared to 5% for clothing and footwear.

He points to data from Stats SA which shows that the total online betting market has grown from “just R10 billion to R150 billion over the last five years”, which puts this as a proportion of GDP at one of the highest ratios in the world.

Clearly, this increase in gambling is taking away disposable income from other categories including the group’s core of “clothing, apparel and homeware” as more than one in four adults in the country is gambling monthly. The retailer says the data suggests that Shein is not immune from this trend, given the change in average basket size over the last 18 months.

Still, this impact should be seen across the industry. Rivals have been outpacing profit growth at TFG, with Pepkor, for example, saying that normalised earnings for the year ended September will be up by 18% to 28%. This stands in strong contrast to TFG, where interim earnings were down 21% for the six months.

In TFG Africa, Ebitda (earnings before interest, tax, depreciation and amortisation) was down 9.7%, with top line growth of just 5.3%. The group maintains this is in line with the market, which according to the Retailers’ Liaison Committee grew by 5.2% over the same period.

TFG’s most recent trading update shocked the market on 21 October, when it forecast a decline in Heps (headline earnings per share) of between 20% and 25%. This was the first time this year it had warned on profit, as top-line growth had remained subdued but decent.

ALSO READ: R1.5 trillion turnover: Online gambling snares South Africa’s youth

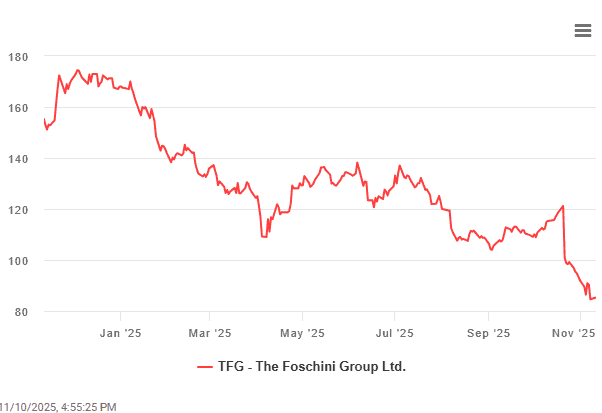

Down 50% in 2025

Investors sharply sold down the stock, with a decline of 30% between 20 October (before the update) and Friday 7 November when it released detailed financials. This drop equates to R12.1 billion in market capitalisation. From the start of 2025, TFG Limited is down around 50%, which equates to R27.5 billion in market cap.

Shares rebounded slightly, ending up 2% on Monday.

Investors (and would be shareholders) remain concerned about not only the weak macro-economic picture in all three of the markets in which it operates and the threat from players like Shein, but also net debt of R10.1 billion, an increase of R3.3 billion in the last six months.

A full R1 billion of this was from the acquisition of White Stuff in the UK, without which sales growth at TFG London would’ve been flat. It says it has R1.5 billion in “excess debt” and another R1.1 billion is being sucked up by working capital ahead of the peak trading period. Its net debt/Ebitda ratio is at 1.55 times, but it says this will normalise by the end of the year due to seasonality.

It continues to believe its shares are undervalued, with R456 million spent on buybacks before the end of September, with another R500-odd million concluded at the end of October.

ALSO READ: Gambling addiction referrals rise 40% as billions spent on betting advertising

The next six months are critical to its full year numbers and it (along with other retailers) will be up against a far higher base in 2024 due to the impact of the two-pot retirement withdrawals that provided stimulus to the economy.

It says it will accelerate the optimising of trading space (trimming store sizes, where it makes sense) and will drive “decisive cost rationalisation”.

Executives are under clear pressure from shareholders and the market.

Coupled with this, it has promised to “review … inventory commitments in light of current trading trends”. The proportion of excess inventory (stock that has been on hand for over 27 weeks) is at the highest in three years (19%). This will be “managed” during its Black Friday promotions.

This article was republished from Moneyweb. Read the original here.