Cropped picture of african american man's hand taking nozzle on gas station.

The beginning of the year is one of the hardest months for some South Africans because they received their salaries earlier than other months and have spent a lot in December.

While parents will be spending more on back to school items, it seems they will be spending less on petrol prices with data from Central Energy Fund (CEF) forecasting a decrease.

Both petrol and diesel are expected to receive a cut, thanks to a stronger rand and a weaker oil price.

ALSO READ: December starts on a sour note as petrol prices increase

Petrol and diesel decreases

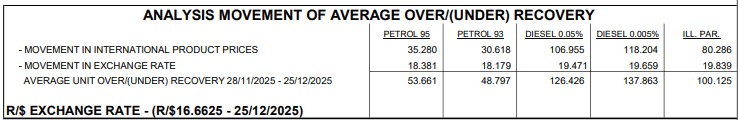

CEF calculates the daily basic fuel price using global oil prices and the rand exchange rate. However, the state energy company doesn’t publish petrol price forecasts, instead analysts watch its daily over/under-recovery numbers to estimate whether prices might go up or down before the government announces the official monthly changes.

Predictions are that South Africans can expect a decrease of 49 cents per litre for 93-octane petrol and 54 cents for 95-octane fuel.

While diesel users might receive the biggest cut, with a decrease between 126 and 138 cents per litre, illuminating paraffin is expected to drop by 100 cents.

Reasons behind the petrol decrease

New petrol prices kick in at 00:01 on the first Wednesday of every month.

If market conditions stay roughly the same, despite the usual ups and downs in the rand and global oil prices, motorists can expect the petrol price cuts to take effect on Wednesday, 7 January 2026.

December usually sees quieter market activity as South Africa and much of the world slow down for the festive season, but the movement that has taken place has been mostly positive.

The rand firmed against the US dollar ahead of Christmas and the Day of Goodwill, supported by stronger gold and commodity prices, as investors continued to move into precious metals.

ALSO READ: Stronger rand expected in December, but did we expect R16.72/$?

The rand and crude oil

On Friday midday, the rand was at R16.7 per dollar, and the global oil price was at $62 per barrel.

“The rand appears to be ending 2025 on the front foot. With the dollar still on the defensive and commodity prices rising to help sustain South Africa’s trade balance in surplus territory, there is solid justification for the rand’s impressive performance,” ETM Analytics said in a note.

According to Bloomberg’s analysis of the markets, the hike came as traders tracked a partial US blockade of crude shipments from Venezuela and a military strike by Washington against a militant group in Nigeria.

The Trump administration has been targeting Venezuelan oil, allegedly taking on drug cartels, and applying pressure on the country’s government.

NOW READ: The remarkable recovery of the rand in uncertain economic times