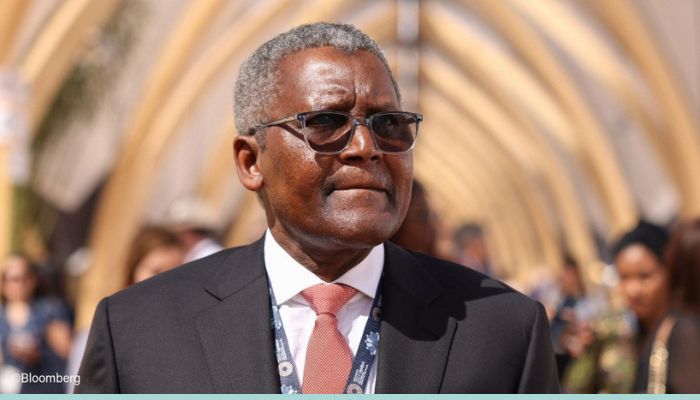

President of the Dangote Group, Aliko Dangote, says the Nigerian National Petroleum Company Limited (NNPC) could increase its current 7.2 percent stake in the Dangote Refinery once the facility fully demonstrates its operational and economic capacity.

Dangote disclosed this in an interview with S&P Global Commodity Insights, where he noted that while the door remains open for the national oil company to expand its equity, such discussions would only happen after the refinery’s next phase of growth is firmly underway.

“I want to demonstrate what this refinery can do, then we can sit down and talk,” Dangote said.

NNPC Stake Cut from 20% to 7.2%

The NNPC had earlier reduced its stake in the 650,000-barrel-per-day refinery from 20 percent to 7.2 percent, a move that generated public curiosity given the project’s strategic importance to Nigeria’s energy future.

A close associate of Dangote told S&P Global that the company intends to proceed cautiously before inviting additional participation from the NNPC or other investors.

Dangote also revealed plans to list between 5 and 10 percent of the refinery’s shares on the Nigerian Stock Exchange within the next year as part of efforts to diversify ownership and attract broader investment.

“We don’t want to keep more than 65 to 70 percent,” he said, adding that share offerings would be made gradually, depending on investor appetite and market conditions.

NNPC’s Focus on CNG Projects

The decision to trim NNPC’s stake was first explained by the company’s former spokesperson, Olufemi Soneye, who said in August 2024 that the energy firm opted to channel resources into developing compressed natural gas (CNG) infrastructure nationwide.

Speaking during an interview, Soneye noted that CNG represents a cheaper and cleaner alternative to petrol, aligning with Nigeria’s broader energy transition goals.

“We realised that gas is cheaper in Nigeria; why don’t we invest in it? That is why the NNPC is building CNG stations everywhere,” he said.

“With N10,000, Nigerians can fill their cars and drive for up to two weeks using CNG.”

Soneye added that the shift reflects the company’s strategy to promote affordable and sustainable energy while easing the cost burden on consumers.

Future Collaboration Still on the Table

Despite the reduced shareholding, NNPC’s Group Chief Executive Officer, Bayo Ojulari, recently told Argus Media that the corporation remains committed to increasing its stake in the refinery in the future.

Dangote’s remarks now confirm that the possibility of renewed investment is still open, but contingent on the refinery’s performance in its upcoming operational phase.

Commissioned as Africa’s largest oil refinery, the $20 billion facility is expected to drastically reduce Nigeria’s dependence on imported fuel and reposition the country as a key energy hub in West Africa.