Governor Cardoso says FX backlog cleared, reserves hit $46.7bn, and inflation drops to 16.05%

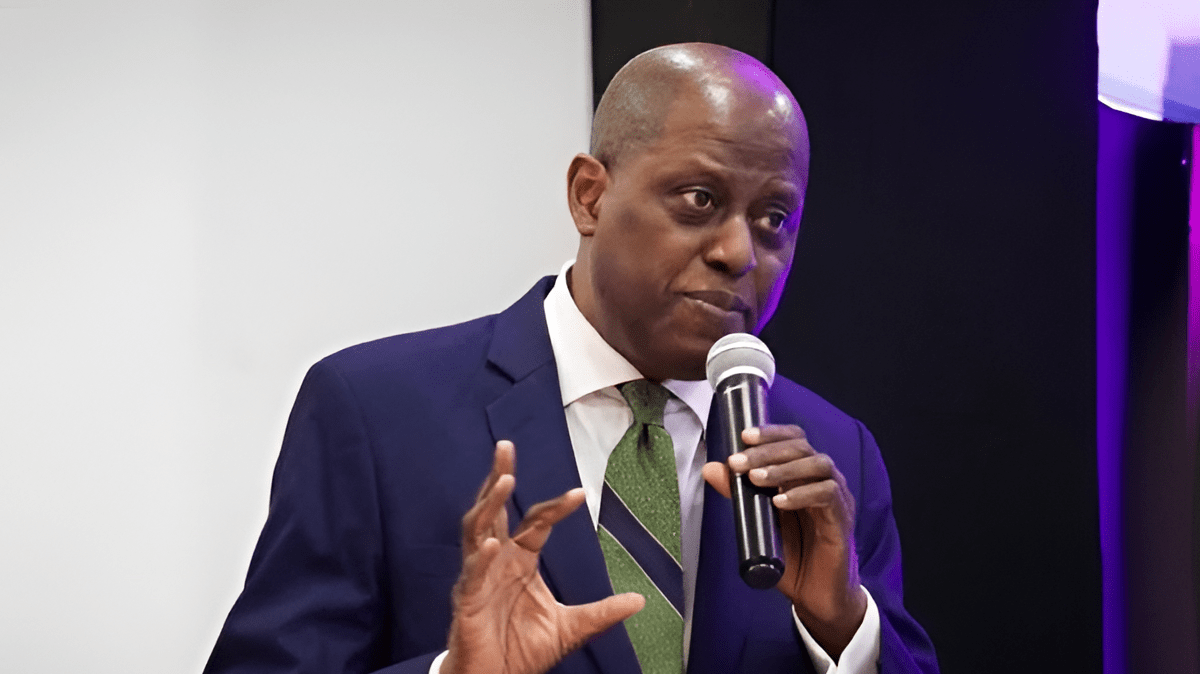

The Central Bank of Nigeria (CBN) on Thursday told the Senate that the country’s economic recovery had entered its most stable and promising phase in over ten years, driven by renewed investor confidence, a historic rise in foreign reserves, steady disinflation, and the near-complete convergence of the foreign-exchange market.

CBN Governor Olayemi Cardoso made the declaration while appearing before the Senate Committee on Banking, Insurance and Other Financial Institutions in Abuja, stating that bold monetary and FX-market reforms introduced since mid-2025 had triggered a broad macroeconomic turnaround now attracting global recognition.

The session opened with a demand for transparency from the committee chairman, Senator Tokunbo Abiru, who pressed the Governor for a full explanation regarding the Auditor-General’s query alleging the non-remittance of N1.44 trillion of the CBN’s 2022 operating surplus.

Abiru, while commending the apex bank for achieving what he described as the most significant stabilisation of the foreign-exchange market in recent years, stressed that public confidence in monetary governance depended on clear, unambiguous responses to the controversial surplus matter. He insisted on details of the facts, corrective actions already taken and the safeguards in place to prevent future breaches.

Responding, Cardoso delivered a detailed assessment of Nigeria’s macroeconomic performance, insisting that all major indicators point to renewed stability.

He reported that headline inflation had fallen for seven consecutive months, plunging from 34.6 per cent in November 2024 to 16.05 per cent in October 2025, the sharpest and most sustained disinflation trend in more than a decade. Food inflation, he added, had eased to 13.12 per cent, supported by stronger domestic supply and a more predictable FX environment.

Cardoso said the foreign-exchange space had been “fundamentally transformed,” with speculative attacks drastically reduced and arbitrage opportunities largely eliminated. According to him, the spread between the official and parallel markets has narrowed to below two per cent, compared with more than 60 per cent a year ago,marking the tightest level of convergence in ten years.

He noted that the naira had shown “remarkable stability,” appreciating to N1,442.92/$ at the Nigerian Foreign Exchange Market (NFEM) as of November 26, stronger than the N1,551 average recorded in the first half of 2025. He attributed the gains to improved liquidity, the rollout of the Electronic Foreign Exchange Matching System, and full activation of the Nigeria FX Code.

One of the most notable developments, he said, was the rise in Nigeria’s foreign reserves to $46.7 billion as of November 14, the highest in nearly seven years and enough to cover 10.3 months of imports. Cardoso also confirmed a surge in diaspora remittances from $200 million monthly to about $600 million, while foreign capital inflows hit $20.98 billion in the first 10 months of 2025, representing a 70 per cent increase over 2024 and over four times the inflows recorded in 2023.

He also reaffirmed that the apex bank had cleared the entire $7 billion verified FX backlog, describing the settlement as a milestone that restored credibility to the Nigerian market and revived investor confidence.

On external balances, he disclosed that Nigeria’s balance-of-payments deficit had narrowed by more than 90 per cent, with the current account position strengthened due to rising non-oil exports, improved terms of trade and active import-substitution strategies. These gains, he said, have drawn global recognition, with S&P upgrading Nigeria’s outlook to “Positive,” Fitch affirming its rating, and the Financial Action Task Force (FATF) removing Nigeria from its Grey List.

Cardoso assured lawmakers that the banking industry remains stable, well-capitalised and positioned to support long-term economic growth. He confirmed that the recapitalisation exercise is progressing smoothly, with 27 banks raising fresh capital and 16 already meeting or surpassing the new thresholds ahead of the March 31, 2026 deadline.

He highlighted improvements in ATM cash availability, stronger oversight of digital-payment systems, enhanced cybersecurity checks and firmer enforcement actions against erring institutions.

However, the Senate panel continued to raise systemic concerns. Abiru questioned the continued application of a 45 per cent Cash Reserve Ratio (CRR) and the rationale behind the 75 per cent CRR imposed on non-TSA public-sector deposits. The committee also sought clarity on forex forward settlements, the spread of mutilated naira notes, persistent failed transactions, excessive bank charges and compliance levels of CBN subsidiaries.

Abiru further requested a full brief on the activities of the Financial Services Regulatory Coordinating Committee for 2025, emphasising that stronger regulatory cooperation was necessary for sustaining market confidence.

Cardoso reiterated the CBN’s commitment to evidence-based monetary policy and transparency in all engagements. He projected a positive outlook for 2026, with inflation expected to ease further, FX stability to hold, and the banking sector to remain resilient. He added that reforms implemented throughout 2025 had laid the groundwork for sustained economic expansion.

He emphasised that continued alignment between fiscal and monetary authorities would be vital in positioning Nigeria as one of Africa’s most attractive investment destinations.