Phased Implementation of Merchant Buyer Solution Aims to Boost Compliance and Transparency…..

The Nigeria Revenue Service has announced the continuation of its phased rollout of the electronic fiscal system (EFS), also known as the Merchant Buyer Solution (MBS), extending implementation to medium and emerging taxpayers across the country.

The initiative is part of NRS’s broader mandate to strengthen tax administration, promote voluntary compliance, and enhance transparency in revenue collection. The e-invoicing platform was first launched for large taxpayers on August 1, 2025, with an extension to November 2025 to allow for operational adjustments and transitional considerations.

Phased Rollout and Implementation Timeline

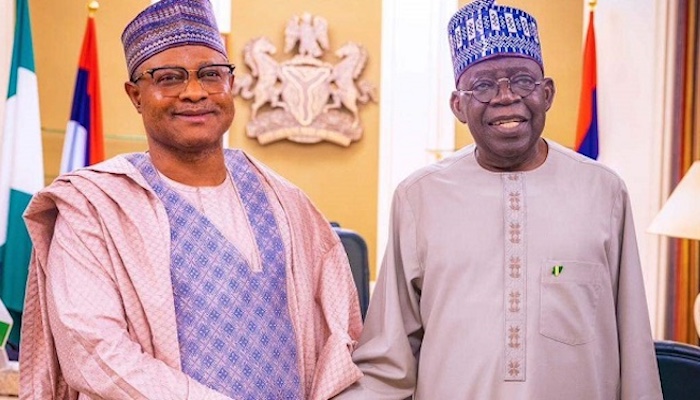

According to Zacch Adedeji, NRS chairman, the rollout will follow a structured, multi-stage approach for each taxpayer category, including stakeholder engagement, pilot rollout, go-live, post go-live review, and compliance enforcement.

Large Taxpayers:

- Post go-live review: January – March 2026

- Compliance enforcement: April – June 2026

Medium Taxpayers (Annual turnover N1bn – N5bn):

- Stakeholder engagement: January – March 2026

- Pilot rollout: April – June 2026

- Go-live: July 1, 2026

- Post go-live review: October – November 2026

- Compliance enforcement: January – March 2027

Emerging Taxpayers (Annual turnover < N1bn):

- Stakeholder engagement: January – March 2027

- Pilot rollout: April – June 2027

- Go-live: July 1, 2027

- Post go-live review: October – November 2027

- Compliance enforcement: January – March 2028

Adedeji urged taxpayers to identify their category, adhere to the timelines, and actively engage with NRS during the onboarding process. He emphasized that the schedule is indicative and may be adjusted based on operational readiness and stakeholder feedback.

NRS Commitment

The NRS chairman highlighted the agency’s commitment to a smooth transition for all taxpayers, ensuring the effective adoption of the e-invoicing system as mandated under Section 23 of the Nigeria Tax Administration Act (NTAA) and Section 158 of the Nigeria Tax Act (NTA).

“Building on our achievements with large taxpayers, we are confident that extending the e-invoicing platform to medium and emerging taxpayers will enhance compliance, reduce leakages, and improve overall tax administration efficiency,” Adedeji said.

The phased rollout is seen as a critical step in modernizing Nigeria’s tax infrastructure and leveraging technology to support a more transparent, accountable, and compliant tax ecosystem.