CBN Data Shows Currency Regains Ground After Last Week’s Mild Weakness…

The naira began the new trading week on a positive note on Monday, appreciating to below ₦1,460 per US dollar, a development that signals renewed calm in Nigeria’s foreign exchange market.

Figures released by the Central Bank of Nigeria (CBN) showed that the local currency traded at ₦1,456 to the dollar, improving from ₦1,466.5/$1 on Friday and ₦1,462.9/$1 on Thursday.

The modest appreciation suggests that the naira is stabilising after experiencing gradual depreciation last week, maintaining a steady trend rather than recording a sharp or speculative rebound.

Market Data Points to Sustained Stability

CBN data indicate that the exchange rate improved from ₦1,462.9/$1 on Thursday to ₦1,456/$1 on Monday, reflecting a week-on-week gain.

When compared with last Monday’s closing rate of ₦1,454/$1, the naira’s movement points to sustained resilience rather than a short-lived recovery.

At the parallel market, currency dealers in Abuja said the naira exchanged at ₦1,481/$1 for buying and ₦1,489/$1 for selling, improving from the ₦1,500/$1 levels recorded on Friday.

Economists and foreign exchange analysts linked the currency’s relative stability to consistent interventions by the CBN, including targeted dollar supply and tighter regulatory oversight.

Why It Matters

The naira’s steady performance offers a cautiously optimistic outlook for Nigeria’s foreign exchange market.

For importers, exporters, and consumers, exchange rate stability provides greater predictability for pricing, contracts, and financial planning. Analysts say sustained stability could improve investor sentiment and reduce exposure to extreme currency swings.

Budget Signals in Focus

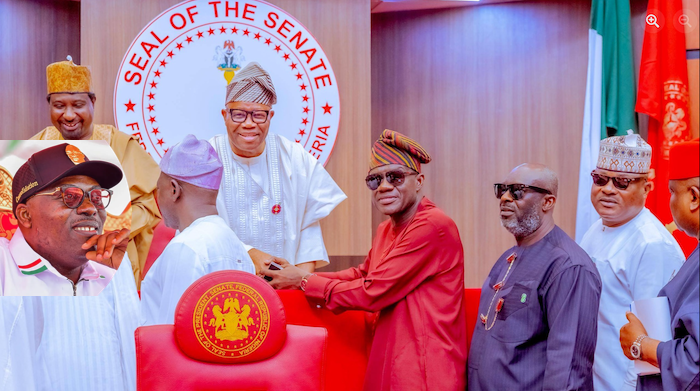

The currency’s movement comes amid broader fiscal developments. On Friday, President Bola Tinubu presented the 2026 Appropriation Bill to the National Assembly, describing the budget assumptions as conservative.

Key projections in the 2026 budget include:

- $64.85 per barrel oil price

- 1.84 million barrels per day crude oil production

- ₦1,400/$ exchange rate

However, analysts have noted concerns following reports that the 2026 budget was presented without the release of a 2025 budget performance report, raising questions about fiscal transparency.

Market watchers say the naira’s latest performance reflects ongoing efforts to balance fiscal expectations with prevailing macroeconomic and foreign exchange dynamics.