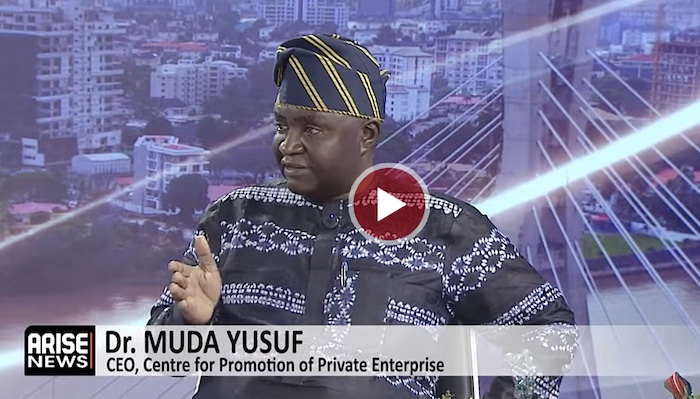

CEO, Centre for Promotion of Private Enterprise, Dr Muda Yusuf said Nigeria’s ability to tackle inflation, weak purchasing power and persistent budget implementation failures hinges on restoring credibility to the country’s 2026 budget.

Speaking In an interview with ARISE NEWS on Sunday, he said recent budget failures were largely caused by unrealistic projections and overlapping appropriations that undermined implementation.

“If a budget doesn’t have credibility, it’s as good as the paper on which it is written.”

Yusuf said the last two budgets failed largely because their foundations were defective. “If you look at the budget of 2025, the assumptions was $75. Oil production was 2.06 million per day, and those were far, far from reality.”

“All of these things had made the budget to be almost unimplementable. If you do something on a faulty foundation, that structure cannot stand.”

He also criticised the practice of expanding budgets beyond initial proposals, recalling that the 2025 budget was presented at about ₦49 trillion before being raised to roughly ₦54 trillion by the National Assembly. “The budget was presented by the President at ₦49 trillion. The National Assembly moved it up to about ₦54 trillion.”

Yusuf welcomed President Bola Tinubu’s public admission of past budget shortcomings, describing it as an important step toward reforming the process. “The good thing about what the President did was to take responsibility and to admit that these anomalies should be corrected. Those anomalies include all these multiple budgets running concurrently.”

“Before the budget presentation itself, he had presented an appropriation to repeal and reenact the 2025 budgets to ensure that they clean up the process.”

I also spoke about the need for realism in the budget. “What I mean by that is to ensure that the assumptions that underpin the budget are also realistic assumptions.”

“if you look at the assumptions, the oil price was $64 per barrel,” noting that “last year it was 2.06 million per day, this time it has been brought down to 1.8 million.”

,when you are budgeting, it is very important that you are a lot more conservative in terms of your revenue.”

“The good thing about what the President did was to take responsibility and to admit that these anomalies should be corrected.”

He said realism must remain central to the 2026 budget, particularly in revenue assumptions. Yusuf noted that the proposed oil price benchmark of $64 per barrel and production target of 1.8 million barrels per day were more aligned with current realities, adding that conservative projections were essential to avoid repeating past mistakes.

According to Yusuf, overestimating revenue leads directly to bloated expenditure plans that governments struggle to implement, leaving ministries, agencies and contractors unpaid. “If you scale it down, then you have to scale down your expenditure. Because what is the point in having huge expenditure?”

There are many MDAs who are complaining that the budget is not being implemented. The contractors are complaining. All of these things arose as a result of defective underlying assumptions of the budget.”

Yusuf cautioned the National Assembly against inflating the 2026 budget during its consideration, warning that additions such as constituency projects often result in spending plans that the country’s revenue base cannot support. “Yusuf said, “The National Assembly has this habit of increasing the budget. There is always talk about constituency projects and all of that.”

At the end of the day, we often have very bloated budgets that the revenue situation cannot support.”

Yusuf said technology-driven monitoring systems and tax reforms could strengthen revenue performance if properly implemented.

“talked about using technology to ensure that all the remittances around the revenue-generating agencies are plugged, and ensuring that all the revenues that are supposed to be remitted are also remitted.”

“There is also expectation around the tax reform, that the tax reform process is also likely to improve the revenue performance.”

If we’re able to tidy up the revenue side, the challenges of implementation, the challenges of deficit, the challenges of debt, those things will be significantly moderated.”

Turning to deficit financing, Yusuf said running a deficit was not inherently problematic but warned that Nigeria was approaching concerning thresholds. “He talked about using technology to ensure that all the remittances around the revenue-generating agencies are plugged, and ensuring that all the revenues that are supposed to be remitted are also remitted. There is also expectation around the tax reform, that the tax reform process is also likely to improve the revenue performance.”

If we’re able to tidy up the revenue side, the challenges of implementation, the challenges of deficit, the challenges of debt, those things will be significantly moderated.”

He noted that the proposed deficit of about 4.28 percent of GDP was slightly above the limits set by the Fiscal Responsibility Act. “Debt servicing is a first-line charge. No matter what your priorities are, you must first and foremost service the debt.”

Yusuf expressed concern that about ₦15 trillion had been allocated to debt servicing against projected revenue of roughly ₦34 trillion meaning nearly half of expected revenue would go toward servicing existing obligations. “Even in this budget, I think debt service provision was about 15 trillion. Because we are talking about revenue expectation of 34 trillion. And there is no guarantee that you will hit that 34 trillion.” Debt servicing is a first line charge. No matter what your priorities are, you must first and foremost service the debt, If your revenue goes down maybe to 25 or something, the percentage of the debt service as a parameter of revenue will go up. So it can go up to 60, 70%. And that will throw you back to the problem of having to borrow more.”

He warned that any shortfall in revenue would push the debt service ratio even higher, creating a vicious cycle of borrowing. “If your revenue goes down maybe to 25 or something, the percentage of the debt service as a parameter of revenue will go up. So it can go up to 60, 70%. And that will throw you back to the problem of having to borrow more.We need to look at issues of debt sustainability. It’s very important.”

There are also concerns about the costs at which we also borrow, particularly all these Eurobonds and these commercial debts. You know, we can maybe do a bit more with what you call the multilateral debt or the bilateral debt. Bilateral debt is the facility you get from country to country. Multilateral is what you get from World Bank, ADB, and the rest of them. Those ones, their terms are much more concessional. But when it comes to commercial debt, it is Eurobond, you know. Their rates are a bit on the high side.”

Yusuf said several state governments were also performing better in budget implementation, suggesting that fiscal management challenges were more pronounced at the federal level. “Even the state governments are not complaining about budget implementation. In fact, many of them are doing much better in terms of budget implementation.”

“I’m personally optimistic that this will be much better than what we had last year.”

“At least we take some lessons from what we experienced with the 2024 budget, 2025 budget, to make sure that the 2026 budget is a much better budget.”

He stressed that macroeconomic improvements alone would not be enough, urging the government to adopt more targeted interventions to address welfare challenges such as food prices, energy costs, transportation, education and healthcare. “Outside all this macroeconomic conversation, we need to be more specific. We need to be more targeted on addressing the welfare issues.”

That is the cost of food, cost of energy, cost of transportation, cost of education, cost of health. There has to be direct.”

Yusuf said restoring credibility, realism and discipline to the budget process was essential if Nigeria was to stabilise its public finances. “If a budget doesn’t have credibility, it’s as good as the paper on which it is written.”

We need to make this budget as realistic as possible, so that we restore the credibility and trust of all the stakeholders in the entire budget process.”

Erizia Rubyjeana