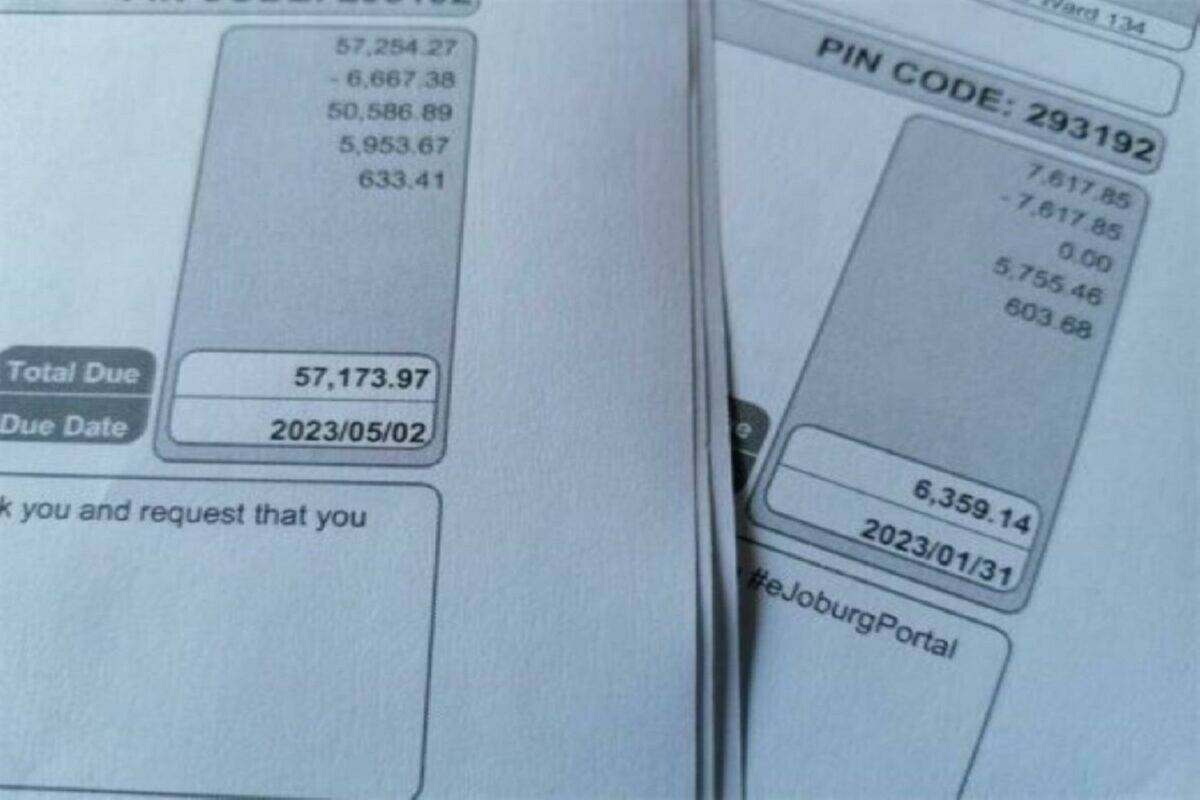

Johannesburg ratepayers are being warned not to rush into signing debt acknowledgment forms, especially when the billing is in dispute.

Legal experts highlight that signing an acknowledgement of debt may do more harm than good, locking them into payments they might not actually owe.

On 1 November, 2025, the City of Joburg launched phase four of its debt relief programme, a 12-month intervention offering write-offs, payment plans and incentives aimed at reducing municipal arrears.

For many households and small businesses, the programme may provide financial relief.

However, experts say its impact will depend on how it is implemented, particularly when residents are disputing charges or are being asked to sign legally binding documents to resolve their accounts.

Pressure to sign acknowledgement of debt

Residents across Joburg report that when historic arrears appear on their accounts, they are often told they must either settle the balance or sign an acknowledgement of debt in order to avoid service restrictions, legal referral or delays in obtaining municipal clearance certificates.

An acknowledgement of debt is recognised in South African law as a formal admission of liability.

Legal practitioners say this has practical consequences for residents who may not understand the legal implications of signing such documents, particularly where accounts contain historic or disputed charges.

According to city documentation, phase four offers qualifying customers:

- Partial or full write-offs of interest and penalties on outstanding arrears;

- Payment arrangements for remaining balances;

- A 100% write-off of interest, legal and miscellaneous charges for eligible accounts;

- Tailored relief, including up to 100% write-offs for pensioners and expanded social package beneficiaries, and 50% write-offs for most residential customers, with the balance payable over 12 to 24 months;

- Relief options for small businesses and certain non-profit organisations; and

- A loyalty reward scheme for consistent payers.

ALSO READ: Joburg rejects billing system failure claims amid mounting debt

Eligibility criteria and disputed charges

Eligibility is conditional. Applicants must be registered property owners, have accounts normalised from the date of application and meet property value and metering requirements.

The city’s programme documentation does not detail how disputed charges or potentially prescribed amounts are reflected on accounts during the relief process.

Legal experts point to two key principles applying regardless of debt relief.

Under the Prescription Act, ordinary municipal service charges such as water and electricity generally prescribe after three years, unless prescription has been interrupted by payment, acknowledgement of debt or legal action.

Secondly, when a billing dispute is raised, municipalities bear the burden of proving the accuracy of meters, consumption and statements.

Legal and civic concerns raised

Schindlers Attorneys, which has acted in several municipal billing disputes, cautioned consumers to approach acknowledgements of debt carefully.

“Consumers should ensure that payments are not allocated to disputed items,” said Schindlers attorney Chantelle Gladwin.

“If payment is made of any part of the debt, this is taken as an admission of indebtedness. It is important that disputes are recorded in writing and that the municipality is clearly informed which charges are contested.”

Gladwin also noted that debt-relief programmes are policy interventions and do not determine whether debt is legally enforceable.

Civic activist Mike Lingwood says the practical effect of current collection practices is that residents are sometimes required to make legal admissions under pressure.

ALSO READ: Province-wide debt threatens Gauteng municipalities

“People sign acknowledgements of debt to stop disconnection or restore services.

“Later, they discover that they’ve limited their ability to challenge charges they believe are wrong,” Lingwood said, adding acknowledgements of debt should not be used to resolve accounts before disputes are properly reconciled.

In response to questions, city spokesperson Nthatisi Modingoane said the city administers prescribed debt in accordance with the Prescription Act and confirmed prescription may be interrupted by payment, acknowledgement of debt or legal action.

The city said prescribed debt should not be regarded as a benefit arising from non-payment and should not be conflated with its debt relief programme, which was a policy intervention aimed at assisting qualifying customers in financial distress.

It said customers are expected to continue paying current charges while disputes or relief applications are being processed.

What residents should clarify before applying:

Legal practitioners advise residents considering phase four to seek clarity on:

- How disputed charges are treated while a debt-relief application is pending;

- Whether signing an acknowledgement of debt is required to access relief;

- How the city distinguishes between enforceable debt, disputed charges and amounts that may have prescribed;

- Whether adjusted statements will clearly reflect reversals, write-offs and remaining balances.

*This article was produced by Our City News, a non-profit that serves the people of Johannesburg

NOW READ: Chaos as CoJ’s billing and payments systems buckle