We all know that smart shoppers beat the festive rush, already relaxing when the rest of us are still running around trying to get the last minute shopping done before the festive season hits. How do they do it?

We asked an expert, Tishalan Pillay, executive director of growth and marketing at ASI Group, who had some sound advice: plan now and shop before the rush, shop at the right places, compare prices and sharpen your financial literacy to help you make the best choices.

ALSO READ: Buying online? This is what to beware of

Plan now, save later: smart shopping ahead of the festive rush

Imagine hearing the constant beep of the till as you watch your total climb higher and higher. It is October, and while the festive season may still feel far off, the spending that comes with it is just around the corner.

From groceries for family gatherings to gifts and travel plans, December tends to stretch household budgets. With the cost of living continuing to rise, planning is more important than ever, Pillay says.

Statistics SA reports that food and non-alcoholic beverage prices increased by 7.2% year-on-year in August 2025. That increase affects everyday purchases, and it is already being felt at the till.

“While inflation is beyond our control, how we respond to it is not. One of the most effective ways to manage increasing costs is to shop with intention, starting now,” Pillay says.

ALSO READ: Money-saving tips to help you shop smarter

Routine vs. value: why it matters where you shop

Most people shop at the same store because it feels comfortable, but Pillay warns this habit can have a downside.

“Consider the small worries you may experience at a new store: not knowing where things are, encountering unfamiliar faces, or worrying about additional costs.

“These feelings often make people stick to their usual stores, even if prices are higher. However, prices can vary significantly between stores, especially for basic items.

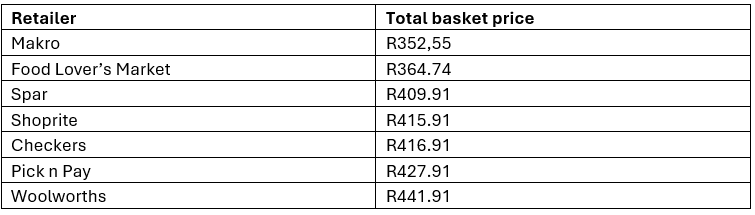

“There have been reports comparing the prices of nine everyday essentials, including bread, sugar, maize meal, flour, rice, oil, milk, toilet paper and soap, at major stores in Gauteng.”

Pillay says this comparison of the prices shows why you have to compare prices and rethink where you shop:

He says choosing Makro over Woolworths for the same basket could save you R89.36. Over a month, that’s more than R350, which is enough to help cover festive costs like petrol, gifts, or additional groceries.

These savings add up, especially during periods of high spending. As a practical exercise, Pillay encourages consumers to try the ‘two-store test’.

“Compare the prices of three everyday items this week between two stores and see for yourself what the potential savings are. This simple experiment can help you discover the value of being a thoughtful shopper.”

ALSO READ: SA consumers prioritise lifestyle over essentials

Financial literacy starts with everyday choices

Financial literacy is not just about investments or retirement planning, Pillay says, but also about understanding your spending habits and making informed decisions.

“Becoming an intentional consumer is one of the simplest and most effective ways to build financial resilience.

“By cultivating these habits, you are not only saving money in the short term but also paving the way towards achieving bigger life goals. Imagine using these savings to fund a child’s education, go on a long-awaited family trip, or finally achieve debt-free living.

“These small, intentional steps today can lead to substantial milestones in the future.”

ALSO READ: Index reveals consumers are willing to spend money, but not too much

Why do prices vary between stores?

This is a question consumers frequently ask, but few can answer. Pillay says several factors influence pricing:

- Bulk buying power: larger retailers often get better deals from suppliers

- Location costs: stores in high-rent areas may charge more to cover overheads

- Brand positioning: Premium retailers often put higher prices on items based on perception, not necessarily product quality.

Understanding these differences helps you make better choices, Pillay says. He has these tips for consumers who want to shop smarter before December:

- Compare prices before you shop: Use flyers, apps, or websites to find the best deals

- Buy in bulk when it makes sense: Stock up on non-perishables like rice or toilet paper

- Stick to a list: Planning your shop helps avoid impulse buys

- Shop with purpose, not habit: Splitting your shop between two stores could lead to better overall value.

ALSO READ: SA consumers shopped till they dropped in December

Small changes can have a long-term impact

Smart shopping is not about cutting corners, but about making your money go further. Pillay says you must remember that every decision at the till adds up, especially during high-spend months like December.

“By comparing prices, questioning your brand loyalty and sticking to a budget, you are not just saving money, you are building habits that support bigger financial goals like saving, managing debt, or preparing for emergencies.”

Pillay says you do not need to be a financial expert to make better choices.

“You just need the right information and a plan. By adjusting your shopping habits now, you are already practicing financial literacy and setting yourself up for a more manageable festive season.

“Before your next grocery run, ask yourself where you can get the best value today? Because smart choices in October make a big difference in December.”