The disruption from Chinese e-commerce players Shein and Temu has been profound. And this is not simply a phenomenon affecting South African retailers.

The aggressive, low-cost business models of these operators has upended retail globally. This is perhaps one reason the share prices of particularly fashion retailers on the JSE have mostly remained depressed.

So far in 2025, shares in Mr Price are down 25%, The Foschini Group (TFG) by 31%, and Truworths by 46%. Woolworths, bolstered by its sizeable Food business, is ‘only’ down 15%, while Pepkor is 10% lower.

In June, consultancy BMA published a research report commissioned by the Localisation Support Fund, which estimated that in 2024, “Shein and Temu collectively achieved approximately R7.3 billion in sales”.

This accounts for nearly 4% of the total clothing retail market and “37% of the sector’s e-commerce sales”. It says this translates to R960 million in lost local manufacturing sales and a total of 8 000 jobs (both lost and “unmaterialised”) since 2020.

Given that neither discloses operational or country-level data, it is difficult to get a handle on just how pervasive these two players have become. Shein entered South Africa in 2020, while Temu’s arrival was far more recent (2024).

The report estimates that their combined 3.6% market share puts them above the combined local market share of Cotton On, H&M, and Zara (3.4%). It must be noted, however, that Temu’s catalogue spans across categories outside of clothing and footwear.

ALSO READ: Jobs and millions of rands lost – Here’s how Temu and Shein are hurting SA

The SA customer

Arthur Goldstuck, MD of World Wide Worx (WWW), says “the closure of tax loopholes, stricter customs enforcement, and the resilience of local retailers have moderated their impact”.

“Their growth is now expected to slow, suggesting coexistence with, rather than displacement of, established players”.

These changes “mean Shein and Temu no longer slip as easily beneath the regulatory radar, and their pricing advantage is likely to narrow further in 2025 and beyond”.

A survey of 1 400 shoppers, as part of WWW’s Online Retail in South Africa 2025 report, shows that roughly half of respondents never shop on international platforms like Shein and Temu, with a quarter shopping on them less frequently than once a month. Regular shoppers (at least once a month) are at 14%.

ALSO READ: Changes coming to Shein in South Africa

Because of their model, effectively offering imports direct to consumers, delivery lead times are long.

Nearly a third of respondents said this was the biggest challenge faced when shopping on these platforms, while another third slammed customs fees and overall shopping costs. The survey says Shein and Temu account for 15.3% of the market, when measuring online retailers used by South Africans last year.

This puts them, combined, in second place behind Takealot (32%) and ahead of Amazon and Superbalist at above 12% each.

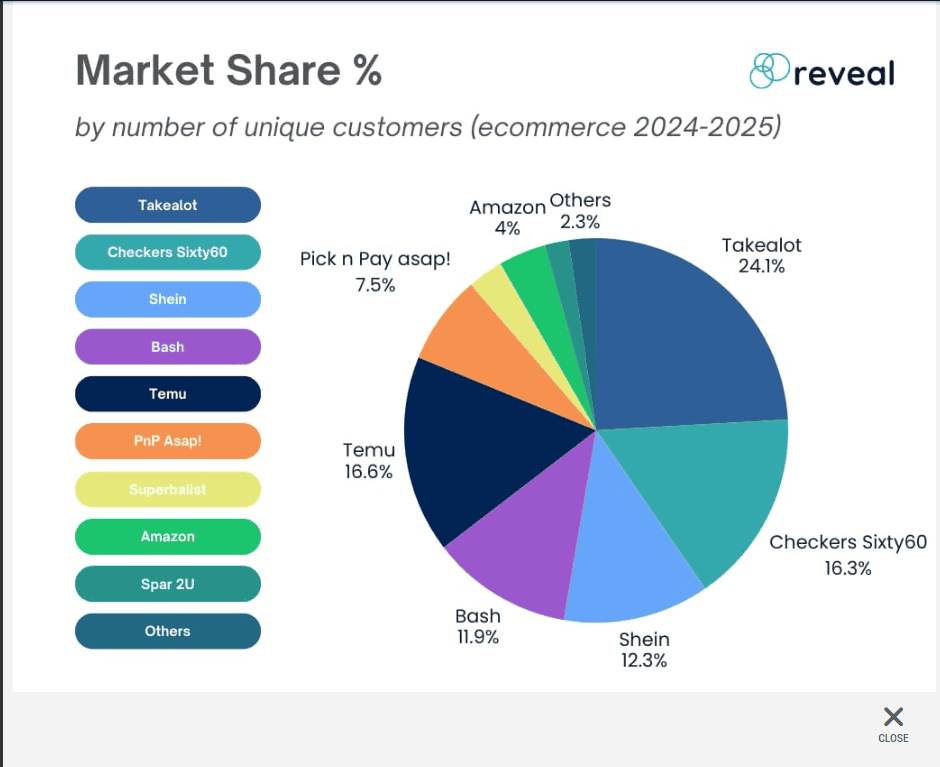

New research from Reveal Insights suggests that this share estimate could be on the low side, especially among more economically active South Africans. Its methodology, which tracks purchase data from a pool of customers, shows that Shein has market share (based on unique customers) of 12.3% in the 2024/25 period, while Temu’s is at 16.6%. This is up from 15.1% and 10.7% respectively in 2023/24.

ALSO READ: Gayton McKenzie accused of not understanding fashion industry after his meeting with Shein

Reveal has Takealot’s share at 24% and TFG’s Bash at 12%.

Source: Reveal Insights

It says “to illustrate their impact on the market, their number of South African customers is comparable to that of Sixty60, the e-commerce leader in the FMCG sector”.

It has Sixty60 at a 16.3% share of the market in 2024/25.

Shein and Temu both gained the most market share between July 2024 and July 2025, with the former growing by 0.74 percentage points and the latter by nearly four percentage points.

Market share (by customer numbers) only tells half the story, though.

Because of the lower price points of items on Shein and Temu, their revenue market share and average basket sizes are highly likely to be lower than these shares.

This article was republished from Moneyweb. Read the original here.