The expected tax windfall from SA’s mining sector, following the surge in commodity prices this year, is set to give Finance Minister Enoch Godongwana a much-needed fiscal fillip when he delivers his 2025 mid-term budget speech on Wednesday (12 November).

And while US President Donald Trump may be a thorn in South Africa’s side on the G20 front, the uncertainty and volatility brought on by Trump’s tariffs globally have played a big role in record gold prices and the PGM (platinum group metals) bull run.

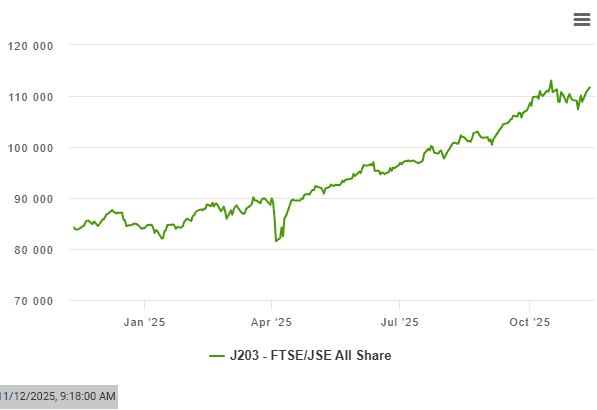

Gold and PGM stocks have been among the biggest gainers on the JSE this year, with the bourse topping multiple records. The JSE All Share Index has surged over 31% year-to-date.

Godongwana and South African Revenue Service (Sars) boss Edward Kieswetter will give the latest details on the tax collections and the scale of the windfall on mini budget day. They could also weigh in on the impact of tariffs on SA-US trade.

Economists have been highlighting an expected tax windfall from surging commodity prices in recent weeks, even with gold tapering off from its record highs. Two-pot pension withdrawals have also contributed to higher tax collections.

Kieswetter told parliament recently that revenue collected to the end of September hit R925 billion, which is 2% higher than the forecast.

This means that Sars collected R18.5 billion more for the first half of government’s current financial year.

ALSO READ: MTBPS: what to look out for in Godongwana’s ‘mini budget’

Meanwhile, Bloomberg reported on Tuesday that Sars “looks set to collect about R20 billion more tax in the current fiscal year than was forecast in May”. It said this is based on Bloomberg survey of economists.

“That should translate into a smaller budget deficit and raise the odds of a credit-rating upgrade by the end of the week,” it added, no doubt following Goldman Sachs on Tuesday touting a sovereign credit-rating upgrade by Friday as it expects an improvement in SA’s public finances.

Speaking on SAfm Market Update with Moneyweb on Tuesday night, ahead of the mid-term budget, Dr Azar Jammine of Econometrix said he expects the government not to abandon fiscal discipline.

“[It is] managing to contain the budget deficit and public debt, to levels lower than people had feared. In fact, latest evidence suggests that government has not spent as much as it said it was going to.

“At the same time, it has been collecting more revenue than anticipated, partly as a result of the surge in precious metals prices and the resultant profits of mining companies,” added Jammine.

ALSO READ: MTBPS: what economists and consumers want to hear

“That means there is a good chance that he will manage to show that the deficit is turning out to be lower than anticipated when he presented [Budget 3.0] in May.”

Commenting further on the likely scale of the windfall from the commodities boom, Jammine said: “We are expecting a substantial windfall … Certainly, more than enough to plug that gap that was going to be plugged with that two [percentage point] Vat hike that caused the February budget to be postponed. I think we are looking at a number somewhere between R50 billion and R100 billion [for the full tax year].”

This article was republished from Moneyweb. Read the original here.