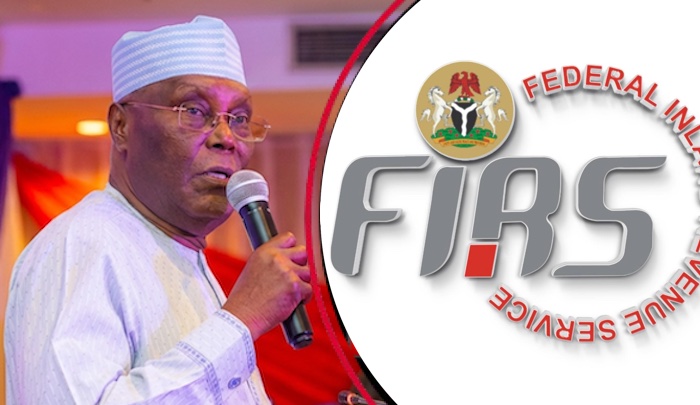

The Federal Inland Revenue Service (FIRS) has rejected allegations by former Vice-President Atiku Abubakar concerning the appointment of Xpress Payments Solutions Limited as one of the platforms for Treasury Single Account (TSA) revenue collection.

Atiku, in a social media post on Sunday, criticised what he described as the federal government’s “quiet appointment” of Xpress Payments, claiming it signalled the return of a “revenue cartel” similar to the Alpha Beta structure associated with Lagos State during Bola Tinubu’s tenure as governor. He argued that the development risked transforming Nigeria “from a republic to a private holding company controlled by a small circle of vested interests.”

The former vice-president’s comments came just days after reports surfaced announcing the FIRS’ approval of XpressPay as part of its payment channels.

Responding on Sunday, Aderonke Atoyebi, Technical Assistant on Broadcast Media to the FIRS Chairman, said Atiku’s claims were “incorrect, misleading, and risk unnecessarily politicising a purely administrative and technical process.” She clarified that the FIRS does not operate a single-gateway system and has not granted any private company a monopoly over federal revenue collection.

“For clarity, the FIRS does not operate any exclusive or single-gateway revenue-collection arrangement, and no private entity has been granted a monopoly over government revenues,” Atoyebi said.

Atoyebi explained that the agency currently runs a multi-channel, multi-payment service provider framework that includes long-established digital platforms such as Quickteller, Remita, Etranzact, Flutterwave and XpressPay. She said these platforms are part of a broad, transparent ecosystem intended to make tax payments more convenient and efficient for Nigerians.

She stressed that payment service providers are not collection agents and do not earn processing fees based on the volume of payments or a percentage of government revenue. All funds paid through the channels, she added, flow directly into the Federation Account without diversion or private custody.

“She stated, “Also, PSSPs are NOT collection agents and DO NOT earn a processing fee per payment, nor a percentage of revenues. Crucially, all revenues collected through these channels go directly into the Federation Account, without diversion, intermediaries, or private control. No PSSP has access to, or custody of, government funds.”

According to Atoyebi, the TSA framework is designed to enhance efficiency, promote job creation, expand market opportunities and ensure transparent onboarding procedures. She further noted that Nigeria’s ongoing national tax reform, driven by the Presidential Committee on Fiscal Policy and Tax Reforms, is anchored on transparency, efficiency and wide stakeholder engagement.

“It is grounded in transparency, efficiency, and broad stakeholder engagement. This reform cannot and should not be dragged into partisan controversy,” she said.

Atoyebi appealed to Atiku and other political figures to stop misrepresenting routine administrative procedures for political gain, emphasising that the integrity of the country’s tax system must not be undermined by misinformation. She reaffirmed the FIRS’ commitment to professionalism, transparency and the continuous strengthening of revenue systems for the benefit of all Nigerians.

“We therefore urge Mr. Atiku Abubakar and other political actors to refrain from mischaracterising routine administrative processes for political gain. Nigeria’s tax system is too important to be subjected to misinformation or unnecessary alarm.”

Melissa Enoch