Starting January 1, 2026, Taxpayer Identification Numbers (Tax IDs) will become mandatory for all taxable Nigerians and anyone engaging in banking, financial services, or contracts with government agencies, according to the newly signed Nigeria Tax Administration Act, 2025.

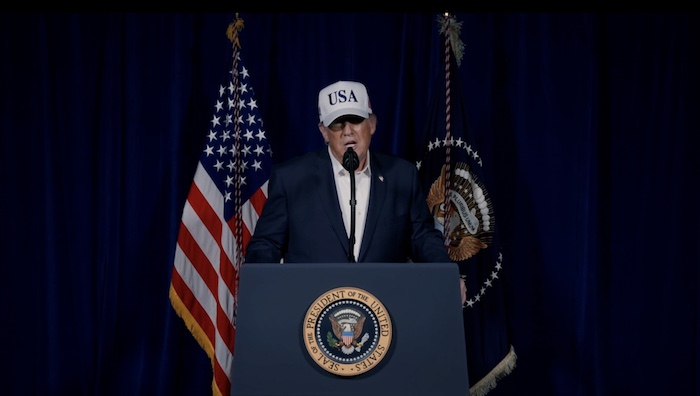

The legislation, signed into law by President Bola Tinubu, introduces sweeping reforms aimed at tightening tax compliance and expanding Nigeria’s digital tax infrastructure.

Under Part II, Section 4 of the Act, every taxable individual must register with a relevant tax authority and obtain a Tax ID card. The same requirement applies to ministries, departments and agencies across federal, state, and local governments.

Non-resident Suppliers, Government Contractors Also Affected

The law also extends its reach to foreign entities doing business in Nigeria. Under Section 6(1), non-residents who supply taxable goods and services to Nigerians are obligated to register and pay tax, making them subject to the Tax ID requirement.

To ensure compliance, Section 7(3) empowers tax authorities to assign a Tax ID to individuals or entities who fail to register. Authorities may also decline an application based on available information, with written notice to be given within five working days.

From 2026, holding a valid Tax ID becomes a condition for:

- Operating a bank account

- Participating in insurance, stock market or allied services

- Entering into any federal or state government contract

These provisions are captured in Section 8(1)(c) and Section 8(2) of the Act.

Suspensions, Deactivations and Dormant Accounts Allowed

The Act makes room for flexibility. Section 10 allows for suspension or deregistration of a Tax ID if a person temporarily or permanently stops doing business.

A business intending to suspend activity must notify the tax authority within 30 days, prompting classification of its Tax ID as “dormant.” Similarly, businesses shutting down permanently must request deregistration within the same timeframe.

Nigeria Revenue Service Gets More Power, Bigger Budget

In a related development, the new Nigeria Revenue Service Act, 2025 establishes the Revenue Service as the central tax agency and grants substantial powers to its Executive Chairman, who will also serve as the Chair of the Governing Board.

The Board will comprise representatives from key government bodies, including:

- Ministry of Finance

- Ministry of National Planning

- Ministry of Petroleum

- Office of the Attorney-General

- Central Bank of Nigeria

- Revenue Mobilisation Allocation and Fiscal Commission

- Nigeria Customs Service

- Corporate Affairs Commission

Executive Directors will be appointed by the President, and the Chairman will serve a four-year term, renewable once.

To fund its operations, Section 22(a) of the Act allows the Revenue Service to deduct 4% of total revenues it collects, excluding petroleum royalties.

Tax Reform Aimed at Broadening the Net

The tax ID system is part of a wider reform agenda by the Tinubu administration to increase fiscal transparency, broaden the tax base, and boost non-oil revenues. Experts say the reforms could significantly raise Nigeria’s tax-to-GDP ratio, which has historically lagged behind regional peers.

The implementation timeline gives businesses and individuals until end of 2025 to ensure compliance.