Despite surpassing its revenue expectations for 2025, the Federal Government is set to ramp up borrowing, citing pressing infrastructure and budgetary gaps drawing fresh scrutiny from economists and public stakeholders alike.

According to a statement released Wednesday by the Special Adviser to the President on Information and Strategy, Bayo Onanuga, Nigeria recorded a significant rise in revenue between January and August 2025. The total inflow reached an unprecedented ₦20.59 trillion, representing a 40.5 per cent jump compared to the ₦14.6 trillion generated during the same period in 2024. The government attributes this increase largely to substantial gains in non-oil revenues, which now account for 75 per cent of total collections.

Onanuga said, “From January to August 2025, total collections reached ₦20.59 trillion, a 40.5 per cent increase from ₦14.6 trillion recorded in 2024. This strong performance aligns with projections, placing the government firmly on course to achieve its annual non-oil revenue target.”

However, this revenue boom has not translated into higher capital spending. Local contractors, under the All Indigenous Contractors Association of Nigeria, staged a protest Wednesday at the Ministry of Finance headquarters in Abuja, demanding payment of ₦4 trillion owed for projects executed in 2024.

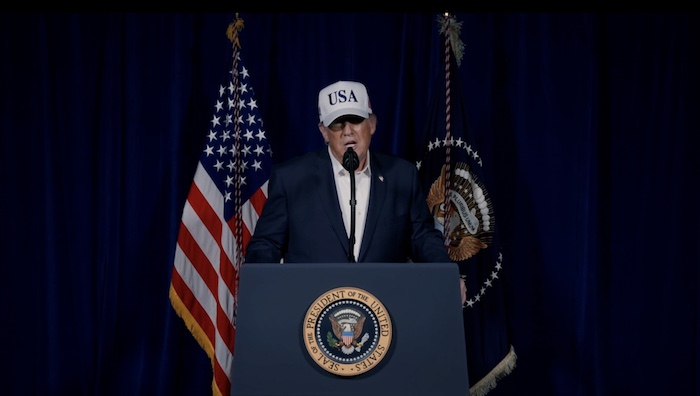

Tinubu’s Fiscal Rhetoric vs Reality

The new borrowing plans appear to contradict recent statements made by President Bola Tinubu, who declared on Tuesday in Abuja that Nigeria had met its 2025 revenue targets ahead of schedule and would no longer rely on borrowing to fund its budget.

Despite that assurance, the government is pursuing both domestic and external loans to address persistent funding shortfalls, especially in infrastructure and public services.

Among the most notable external funding sources is the World Bank, which is expected to approve $1.75 billion in loans for Nigeria before the end of the year. These funds are earmarked for critical development projects across sectors such as agriculture, health, digital infrastructure, and MSME financing.

Breakdown of Expected World Bank Projects

The $1.75 billion loan package is set to support four major initiatives:

- Nigeria Sustainable Agricultural Value-Chains for Growth Project – $500 million

- Focus: Boosting productivity and linking farmers to markets.

- Status: Concept Review phase, approval expected December 11, 2025.

- Building Resilient Digital Infrastructure for Growth – $500 million

- Focus: Strengthening Nigeria’s digital backbone to support innovation and technology-driven growth.

- Status: Begin Negotiation phase, approval scheduled for October 31, 2025.

- Health Security Programme in Western and Central Africa (Nigeria Phase II) – $250 million

- Focus: Enhancing preparedness and response to health emergencies.

- Status: Begin Negotiation phase, approval expected September 30, 2025.

- Fostering Inclusive Finance for MSMEs – $500 million

- Focus: Expanding access to credit for small and medium-scale enterprises.

- Status: Concept Review phase, approval slated for December 18, 2025.

The upcoming disbursements form part of a broader World Bank lending portfolio to Nigeria. Over the past two years (June 2023 – August 2025), the World Bank approved $8.4 billion in new loans across 15 projects spanning energy, education, health, and governance. This includes $1.95 billion from the International Bank for Reconstruction and Development (IBRD) and $6.5 billion from the International Development Association (IDA).

Debt Profile Raises Concerns

According to the Debt Management Office (DMO), Nigeria’s total debt to the World Bank rose to $18.23 billion as of March 31, 2025, up from $17.81 billion just three months earlier. This includes:

- IDA Loans (concessional): Increased from $16.56bn (Dec 2024) to $16.99bn (March 2025)

- IBRD Loans (commercial terms): Unchanged at $1.24bn

This means the World Bank alone now accounts for 39.7 per cent of Nigeria’s total external debt stock, which stood at $45.98 billion as of Q1 2025. Within multilateral loans, the World Bank represents 81.2 per cent, up from 79.8 per cent at the end of 2024.

Meanwhile, Nigeria’s overall public debt has ballooned to ₦149 trillion, up from ₦87 trillion in mid-2023. Analysts project that figure could approach ₦180 trillion if borrowing continues at the current pace.

Nigeria’s fiscal landscape is at a crossroads. While rising non-oil revenues paint a promising picture, the continued reliance on domestic and foreign loans particularly amid growing debt obligations raises questions about fiscal discipline, transparency, and long-term economic sustainability.