Commission removes defaulting lenders from approved register as enforcement of 2025 digital lending rules enters new phase

The Federal Competition and Consumer Protection Commission (FCCPC) has commenced a phased enforcement of sanctions against Digital Money Lending operators that failed to regularise their operations in line with the Digital, Electronic, Online and Non-Traditional Consumer Lending Regulations, 2025.

The compliance deadline for affected operators expired on Monday, January 5, 2026. In a statement issued on Wednesday, the Director of Corporate Affairs at the FCCPC, Ondaje Ijagwu, said the enforcement exercise is aimed at strengthening regulatory certainty and restoring confidence in Nigeria’s rapidly expanding digital lending sector.

According to the Commission, the enforcement follows the close of the transitional compliance window granted to operators under the new regulatory framework.

“The Federal Competition and Consumer Protection Commission has commenced a phased implementation of enforcement measures in respect of Digital Money Lending operators that failed to regularise their status in accordance with the Digital, Electronic, Online and Non-Traditional Consumer Lending Regulations, 2025,” the statement said.

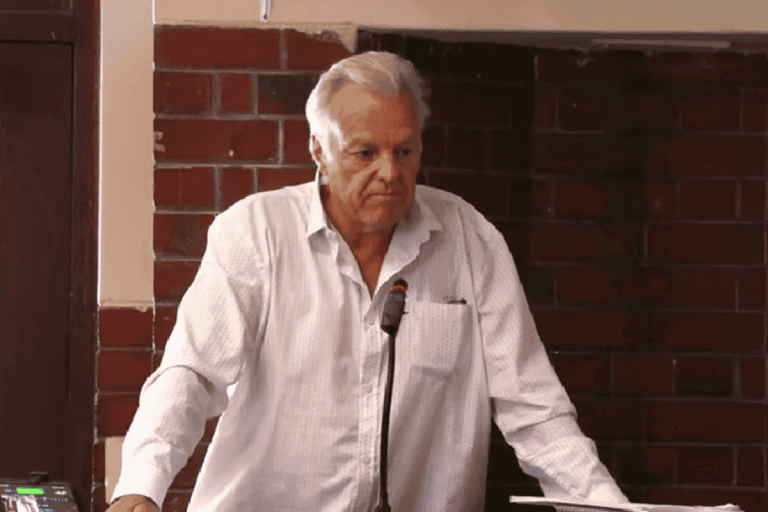

Commenting on the development, the Executive Vice Chairman and Chief Executive Officer of the FCCPC, Tunji Bello, said the action was necessary to give full effect to the regulations and to curb abusive practices that have plagued the sector.

“The compliance window provided under the Regulations has now closed. At this stage, the Commission is proceeding with appropriate enforcement steps in a manner that is fair, orderly and consistent with due process,” Bello said.

He stressed that the objective of the enforcement was not to disrupt legitimate businesses but to promote discipline, transparency and consumer confidence in the digital lending market.

As part of the enforcement framework, the FCCPC has withdrawn the conditional approvals previously granted to digital lenders that failed to complete the regularisation process during the transitional period.

The Commission also confirmed that defaulting operators have been removed from its publicly available register of approved digital lenders, pending full compliance with the applicable regulatory requirements.

Bello explained that the FCCPC register serves as a critical consumer protection tool, enabling the public to identify lenders that meet established regulatory standards.

“The register is intended to guide consumers on operators that have complied with regulatory requirements at the time of publication. Nigerians are advised to exercise caution when dealing with digital lenders that do not appear on the Commission’s current list of approved operators,” he said.

In addition, the FCCPC said it has begun structured engagement with application hosting platforms and payment service providers as part of its statutory enforcement and compliance monitoring responsibilities. The Commission noted that further regulatory actions would be taken in line with the law and established procedures.

For operators provisionally designated as eligible under transitional arrangements, the FCCPC has set April 2026 as the final deadline to complete their registration under the DEON Regulations.

“This window is provided to enable affected operators to take concrete steps towards compliance. Operators that fail to regularise their status within this period may face additional regulatory measures as provided by law,” Bello stated.

The Commission emphasised that the enforcement process is designed to strengthen market discipline, protect compliant operators from unfair competition, and shield consumers from abusive, deceptive or unlawful lending practices.

“Effective regulation requires consistency. Compliant businesses deserve a predictable regulatory environment, while consumers are entitled to protection under the law,” Bello added.

Nigeria’s digital lending market has expanded rapidly in recent years, driven by increased smartphone usage, wider mobile internet access and limited access to traditional bank credit. However, the sector has also been criticised for high interest rates, unclear loan terms, harassment of borrowers, data privacy breaches and unauthorised access to users’ contacts.

These concerns prompted the FCCPC to introduce stricter oversight through the DEON Regulations, which mandate registration, ownership disclosure, compliance with data protection standards and adherence to fair lending and debt recovery practices.

In previous enforcement actions, the Commission ordered the removal of several loan applications from app stores and sanctioned operators found to have engaged in unlawful debt recovery practices, including public shaming and intimidation.

With the latest phase of enforcement underway, the FCCPC reaffirmed its commitment to transparent regulation, fair competition and effective consumer protection across Nigeria’s digital economy, warning that non-compliant operators will remain under sustained regulatory scrutiny.