The South African Revenue Service (Sars) has become more agile, but also more demanding and “information-rich”. This highlights the need to balance enforcement with transparency and support.

The latest PwC Taxing Times survey shows that although there are signs of progress with faster turnaround times and greater use of data by Sars, there are also “persistent concerns” about procedural fairness, consistency and communication.

The survey engaged 200 corporate taxpayers across 18 industries, and spotlights the relationship between Sars and the business community.

ALSO READ: Warning to influencers selling and promoting fake LV and Gucci bags online

Improved turnaround times

The survey shows that Sars’s turnaround times to finalise audits have improved.

More than 30% of the respondents indicated that their audits were finalised within one to three months.

This is up from 28% last year and 19% in 2023. Audits lasting three to six months rose from 28% last year to 32%, while those lasting six months to a year fell slightly to 20%. Audits lasting more than a year dropped to 17%, down from 23% last year and 24% in 2023.

“These results suggest that, while longer audits remain a concern for some taxpayers, Sars is making incremental progress in reducing extended audit durations and improving overall efficiency,” says Elle-Sarah Rossato, tax controversy and dispute resolution leader at PwC.

It should be noted that the survey did not test participants’ views on the quality of assessments, only the duration of the audits, she adds.

ALSO READ: Sars says goodbye to remote work

Less penalties

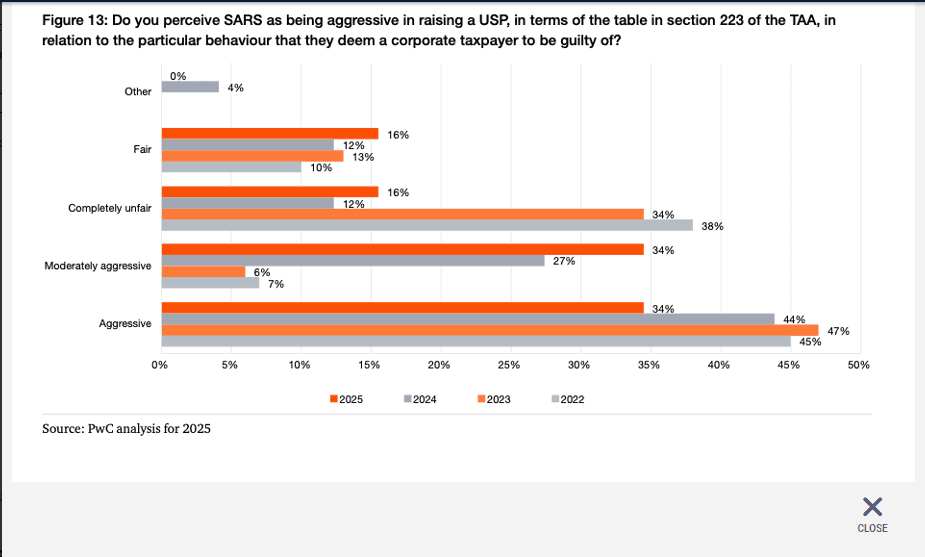

In terms of the Tax Administration Act (TAA), Sars may levy understatement penalties, with the penalty rate depending on the conduct of the taxpayer.

Understatement penalties range from substantial understatements attracting a rate of 10% to intentional tax evasion attracting a penalty rate of up to 200%.

Fewer penalties were issued this year – 30% of participants reported receiving a penalty compared to 37% in the previous year.

However, Sars has adopted a more assertive stance towards non-compliant taxpayers. This is evident from stricter enforcement of timelines and a zero-tolerance posture in cases of default.

ALSO READ: Report by Sars and Tax Ombud to reveal pattern of e-filing hijackings

Global minimum tax

The survey for the first time tested taxpayers’ experience with the Organisation for Economic Cooperation and Development’s (OECD) global minimum tax initiative.

Pillar II introduces a 15% global minimum tax rate for large multinational enterprises with consolidate annual revenues of €750 million or more.

The survey notes that 38% of the respondents understood the purpose of the initiative, while almost half were not concerned about the impact on them. The goal of the initiative is to ensure that large international corporates pay a minimum amount of tax in the jurisdictions where they operate to prevent shifting of profits to low-tax jurisdictions.

ALSO READ: Estimated assessments: Sars’s new ‘cash-cow-grabbing’ norm?

Making things right

A permanent feature of the TAA is the voluntary disclosure programme (VDP) that allows taxpayers to regularise their affairs without fear of penalties or prosecution.

However, applications must adhere to certain criteria. According to Rossato, there has been a shift in Sars’s approach when considering VDP applications.

“Rejections are increasingly due to refund positions and recent defaults, marking a departure from previous years where voluntariness and completeness where the primary barriers.”

This year, 37% of the participants saw their applications finalised between three and six months, which is down from 43% in 2024. Last year, 32% saw their applications being dealt with between one and three months. This declined to 28% this year.

A substantial proportion of participants (79%) who utilised the VDP indicated that it facilitated their company’s proper declaration of defaults, enabling them to correct assessments and avoid penalties for understatement. Only 9% reported that the VDP process was not beneficial.

“These trends highlight the importance of understanding Sars’s current expectations and preparing robust applications to avoid delays or denials,” says Rossato in a statement.

ALSO READ: Now that you submitted your tax return to Sars, what comes next?

Ease of compliance

When asked whether it became easier to comply with tax obligations, 65% of the participants indicated that it did. This is an 11% improvement from the previous year. This is a positive outcome, given that one of Sars’s strategic objectives is to simplify compliance.

However, the fact that 35% are still struggling suggests that Sars’s systems and processes are difficult for taxpayers to understand and navigate.

The PwC report suggests that Sars could address this by establishing direct communication channels with technical specialists to assist taxpayers to interpret and apply tax legislation effectively.

“The call centre, however, appears to offer limited support and is aimed more at personal income taxpayer (as opposed to corporates),” it is noted in the report.

It does appear that trust in Sars has improved, with 51% reporting that their level of trust has remained unchanged. This is up from 46% in 2024.

Despite improvements with the processing of value-added tax (Vat) refunds and quicker finalisation of audits, ongoing concerns remain. This includes Sars missing its own deadlines, slow dispute resolution with repeated information requests, and minimal feedback. Taxpayers feel there is a lack of fairness and accountability in assessments.

The overall sentiment is that although there is trust in systems, execution is inconsistent. Good service is “rare”, with many taxpayers feeling service delivery has stagnated.

This article was republished from Moneyweb. Read the original here.