Old Mutual Bank, which launched to the public in September, has grand ambitions. It aims to be profitable by 2028 – and to do so, it will need between 2.5 million and three million customers, of which around 500 000 will be dormant.

The decision to enter the banking space as a standalone insurer (it previously owned a majority stake in Nedbank before the managed separation of the plc entity into four units a decade ago) has been a bold one. But will it be the correct one?

To date, it has spent R2.8 billion actually building the bank with nearly R2 billion of this dedicated to the core technology build-out.

It sees the loss run rate at between R1.1 billion and R1.3 billion a year, which will reduce towards its planned break-even. Plus, it has allocated R1.6 billion in capital to the bank for 2026. Including losses and capital, this means an investment of closer to R8 billion (perhaps as much as R10 billion) by the time it turns profitable.

ALSO READ: Here is how much it cost Old Mutual to build its near-to-launch bank

‘Gap’ in the market?

Old Mutual is not exactly entering an uncrowded market:

- The ‘big four’ are, well, the big four;

- Investec has sewn up the (true) private banking market;

- Tyme Bank has acquired over 11 million customers, although many of these are not necessarily active;

- Discovery Bank has turned profitable and continues to add customers across the income spectrum;

- African Bank continues to focus on its retail ambitions, albeit from a modest base;

- Lesaka Technologies has ambitions of its own and acquired Bank Zero for R1 billion in the middle of 2025; and

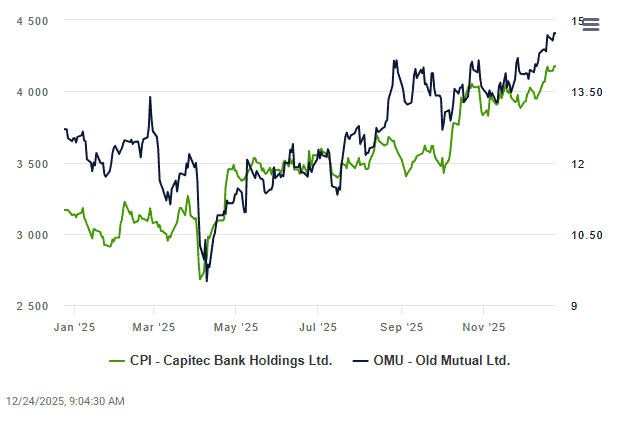

- Then there’s the 24.4 million client gorilla in the room, Capitec Bank, which is steadily growing its personal banking client base year after year.

However, it is two recent announcements by arguably the country’s two best retailers that should have Old Mutual executives nervous.

ALSO READ: After unbundling Nedbank in 2018, Old Mutual will launch a bank in 2024

Shoprite and Pepkor

Shoprite CEO Pieter Engelbrecht admitted in September that “you’re going to see us enter the banking world …”.

“We are definitely going to enter the financial services area more aggressively. We have customers who trust the brand. Because of this trust, we feel comfortable to get more involved in the financial services world.”

After murmurs that it would tie up with Investec (a move which would make absolutely zero sense), Pepkor announced in November that it had received Section 13(1) approval from the Prudential Authority to establish a banking presence in the country.

Not unlike Shoprite, this is a business with financial services activity that already operates at scale.

Pepkor processes over 22 million cash deposits and another more than 22 million cash withdrawals each month, with in excess of two million money transfers.

Over four million bills are paid at its stores monthly, on average. With lending, it grants more than 65 000 loans and 173 000 phone rental agreements under its immensely popular Fone Yam service monthly. This service has more than two million active customers, an increase of 140% since FY2024.

ALSO READ: Capitec captures high-earners: 27% growth in clients earning R50 000+ monthly

It also sells in excess of 20 000 funeral policies a month, with one million lives covered in a R19.7 billion book.

No wonder it wants to get into banking. Across its brands, it has 32.5 million customers which is about half the population.

It has processed 16 million Rica (Regulation of Interception of Communications and Provision of Communication-Related Information Act) registrations and seven million credit applications, so it knows a little more about these people.

Add to this a footprint of 6 000 stores in every single corner of South Africa and you can easily see why it makes sense.

It is also diversifying, into embedded businesses like Pep Home (an adjacency), parcel service Paxi, Fone Yam, as well as new segments (so-called off-price retail) and geographies (Avenida in Brazil), as it’s not exactly likely to double its 6 000-store footprint in the next five or 10 years. That growth has largely been delivered.

ALSO READ: Capitec Bank loses its crown as Africa’s most valuable bank. Here’s the new ranking

Tall order

The looming problem for Old Mutual is not only that existing rivals will compete for customers (never mind new entrants like digital bank Revolut which will apply for a full banking licence) but that Pepkor’s typical customer, Shoprite’s core customer, and Old Mutual’s existing 5.4 million policyholders and customers in South Africa are almost entirely the same people.

How do you compete against a Shoprite that already charges zero monthly account fees and also doesn’t charge for deposits, money transfers, bill payments or prepaid purchases?

Pep will no doubt follow a similar strategy.

To be clear, the market looked decidedly different in 2022 when Old Mutual announced this plan to establish a bank. A decision like this would’ve been in the works years earlier.

At that point, the strategy might’ve looked inspired. It has a sizeable existing customer base as well as distribution and if banks were moving into the insurance space, wouldn’t it make sense for an insurer to move into banking?

Fast forward and given Capitec’s inroads into the space, Old Mutual hopes the bank will help it take back market share in funeral cover.

ALSO READ: Standard Bank pockets R24 billion in six months, while Capitec eyes earnings to surge above 22%

It is not as if CEO Jurie Strydom had anything to do with the foray into banking. He has to live with it, however, and ensure he does his best to drive the bank to profitability. If it works, he, Bank CEO Clarence Nethengwe, and other executives and board members get to take the credit. If it doesn’t, they can point to the past and try limit the group’s losses.

Investors will be watching its coming results updates carefully for signs that the current strategy for the bank is working, but there’s rather a lot that can change by 2028.

The challenge won’t necessarily be seen in the next 12 or even 24 months, where it may well continue to add customers in line with its business plan. The problem may only appear in two or three years’ time once Shoprite and Pepkor aggressively enter the banking space and start picking off Old Mutual Bank customers 1 000 at a time.

This article was republished from Moneyweb. Read the original here.