The Central Bank of Nigeria (CBN) has reduced the Monetary Policy Rate (MPR) by 50 basis points, bringing it down from 27.5% to 27.0%, marking the first interest rate cut in 2025.

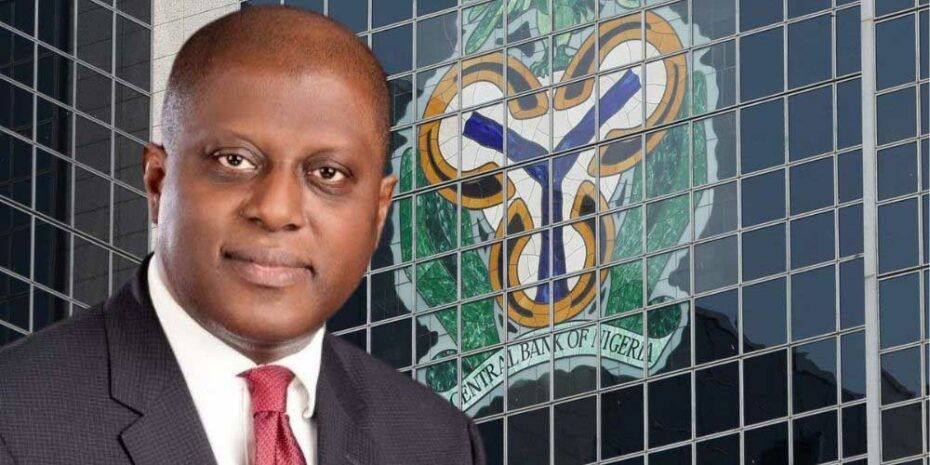

This was announced by CBN Governor Olayemi Cardoso during a press briefing in Abuja on Tuesday, following the conclusion of the 302nd meeting of the Monetary Policy Committee (MPC) held on September 22nd and 23rd, 2025.

“The Committee decided as follows: (1) reduce the monetary policy rate by 50 basis points to 27 per cent,” said Dr. Cardoso.

Policy Moves at a Glance

- MPR: Reduced to 27.00% from 27.5%

- Cash Reserve Ratio (CRR):

- Commercial banks: Reduced to 45%

- Merchant banks: Retained at 16%

- Liquidity Ratio: Retained at 30%

- Asymmetric Corridor: Maintained at +260/-250 basis points

- New CRR Rule: Introduced 75% CRR on non-TSA public sector deposits

Cardoso explained that the MPC’s decision was driven by:

- Five consecutive months of disinflation

- Positive projections for further inflation decline in Q4 2025

- Stable exchange rate

- Rising crude oil production

- Strong external reserves

- Moderating petrol prices (PMS)

- A surplus current account balance signaling increased capital inflows

“The committee believes the current macroeconomic stability offers headroom for monetary policy to support growth and recovery,” he added.

This 50-basis point reduction comes after the MPC held interest rates steady in its last three meetings, amid cautious optimism over Nigeria’s inflation trajectory and exchange rate stability.

The MPC expressed satisfaction with improvements in key economic indicators, including:

- Real GDP growth

- Disinflation momentum in August 2025 (the strongest in 5 months)

- Improved monetary policy transmission

Economists see the rate cut as a signal of renewed focus on economic growth, particularly as inflation shows signs of moderation. Lower rates could:

- Ease borrowing costs for businesses and consumers

- Spur private sector investment

- Support job creation and domestic production

However, analysts also caution that sustained gains will depend on maintaining exchange rate stability, fiscal discipline, and oil production targets.