The Central Bank of Nigeria (CBN) says investor confidence in the country’s economy is steadily improving, buoyed by ongoing reforms that have stabilised the naira, slowed inflation, and increased transparency in monetary operations.

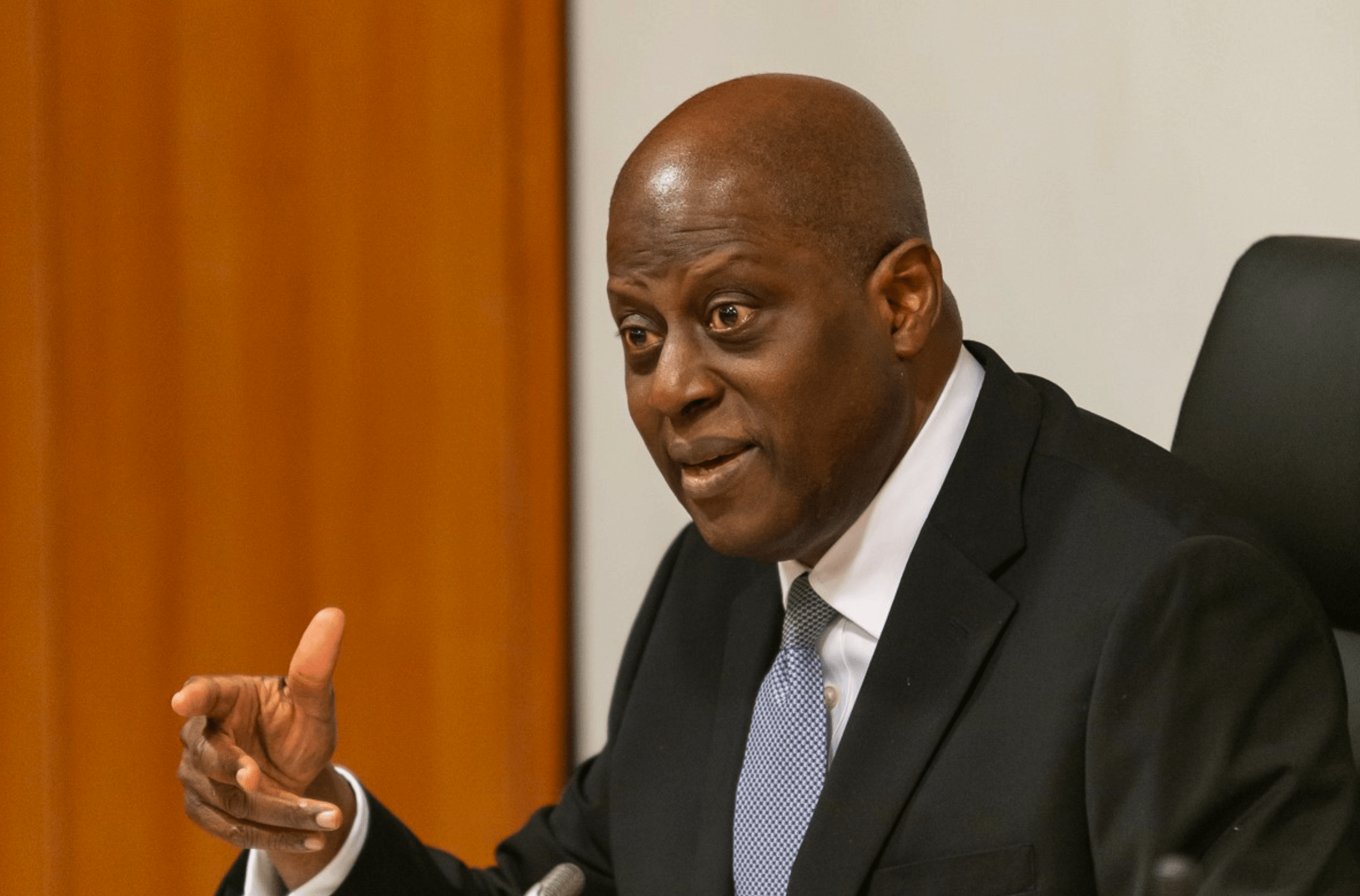

Speaking at a press conference on the sidelines of the IMF–World Bank Annual Meetings in Washington, D.C., CBN Governor Olayemi Cardoso said recent engagements with global investors, rating agencies, and development partners have reflected “a tone of confidence and constructive partnership” toward Nigeria’s reform path.

“There is broad recognition that Nigeria’s reforms are delivering results: inflation is moderating, the exchange rate has stabilised, and investor confidence is returning,” Cardoso said.

He revealed that the Nigerian delegation held extensive meetings with officials of the IMF, World Bank, IFC, Fitch, Moody’s, and S&P, as well as international investors, development partners, and other central banks.

Naira Stability and Strong Reserves

Cardoso noted that the naira continues to strengthen, with the gap between the official and Bureau de Change (BDC) rates narrowing to below 2 percent, indicating growing market confidence and reduced speculation.

He added that Nigeria’s foreign reserves have risen above $43 billion, providing over 11 months of import cover, supported by renewed capital inflows and increased investor participation across asset classes.

Inflation, he said, fell for the sixth straight month in September to 18.02 percent, down from 20.12 percent in August, the lowest level in three years. Both core and food inflation also declined, driven by disciplined monetary tightening, exchange rate unification, and improved market transparency.

“These indicators show that the policy adjustments undertaken over the past two years are producing the right results,” he said. “Our focus remains on sustaining stability, deepening reforms, and ensuring that macroeconomic gains translate into better livelihoods for Nigerians.”

Fiscal Reforms Strengthen Investor Confidence

The CBN Governor, who was joined by Minister of State for Finance, Doris Uzoka-Anite, said coordination between fiscal and monetary authorities has further boosted confidence among international partners and investors.

He noted that fiscal measures under President Bola Tinubu’s administration including fuel subsidy removal, expenditure rationalisation, and revenue mobilisation are helping to rebalance public finances and free up resources for investment in infrastructure, education, and healthcare.

Cardoso added that non-oil revenues are rising, while improved security in oil-producing regions and targeted incentives have attracted over $8 billion in new energy investments.

Regional Cooperation and Global Leadership

As part of outcomes from the Washington meetings, Cardoso announced that Nigeria signed a Memorandum of Understanding (MoU) with the Central Bank of Angola to strengthen monetary cooperation and enhance financial stability across Africa.

He also disclosed that Nigeria will assume the chairmanship of the Intergovernmental Group of Twenty-Four (G-24) on November 1, 2025, taking over from Argentina. The G-24 represents developing countries within the Bretton Woods system, coordinating their positions on international monetary and development issues.

“This appointment reflects international confidence in Nigeria’s leadership and reform credibility,” Cardoso said. “Our story is one of resilience, a nation aligning courage with conviction to build a more competitive, innovative, and inclusive economy.”