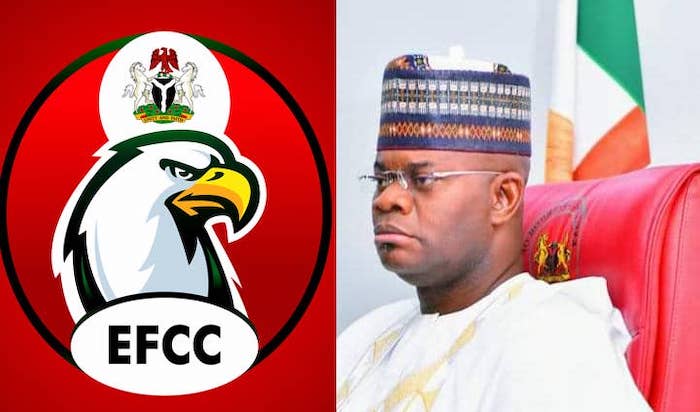

The fourth prosecution witness in the alleged money laundering trial of former Kogi State Governor Yahaya Bello has testified that withdrawals made by the state government did not breach any banking regulations.

During cross-examination before Justice Emeka Nwite of the Federal High Court, Abuja, on Monday, Mshelia Arhyel Bata, a compliance officer with a commercial bank, reiterated that Governor Bello’s name did not appear as a beneficiary in the account presented as evidence.

Senior Advocate of Nigeria (SAN) Joseph Daudu, representing the defence, highlighted withdrawals made by Umar Olufunke that the prosecution had not referenced.

However, the EFCC had focused primarily on withdrawals conducted by Abdulsalam Hudu, the cashier of the Kogi State Government House.

According to the witness, these withdrawals, often in multiples of ₦10 million, occurred between December 2017 and April 2018, with beneficiaries including various hotels across the state.

Under cross-examination, Bata also confirmed withdrawals made by Alhassan Omakoji between November 2021 and December 2022, which did not exceed ₦10 million per transaction.

He explained that these were within the limits prescribed by the Central Bank of Nigeria (CBN). The witness further admitted that he was not aware of any law regulating how the Kogi State Government spends its allocations and could not determine the purpose of the transactions beyond the named beneficiaries.

Following Bata’s testimony, the fifth prosecution witness, Jesutoni Akoni, a compliance officer with Ecobank Plc, was called to testify. Akoni tendered a subpoena and a statement of account of Moses Ailetu companies for January 2016, which was admitted as Exhibit 29.

The witness confirmed cash deposits ranging from ₦3 million to ₦20 million, totaling ₦57 million, and stated that former Governor Bello was not a beneficiary of the deposits.

Akoni also acknowledged that the source of the funds could not be discerned from the documents presented.

The sixth witness, Mohammed Bello Hassan, a relationship officer at Keystone Bank, produced statements of account for Dantata and Sawoe, which were admitted without objection by the defence.

The seventh witness, Olomotame Egoro, a compliance officer from Access Bank, confirmed the submission of 12 sets of documents as requested.

While the defence did not object to the statements of account themselves, they raised concerns about some of the additional documents extracted from the account opening packages.

The prosecution clarified that these supplementary documents were provided voluntarily, believing they might be needed, and subsequently began detaching irrelevant materials at the court’s instruction.

Justice Emeka Nwite adjourned the trial to November 11, 2025, for continuation.