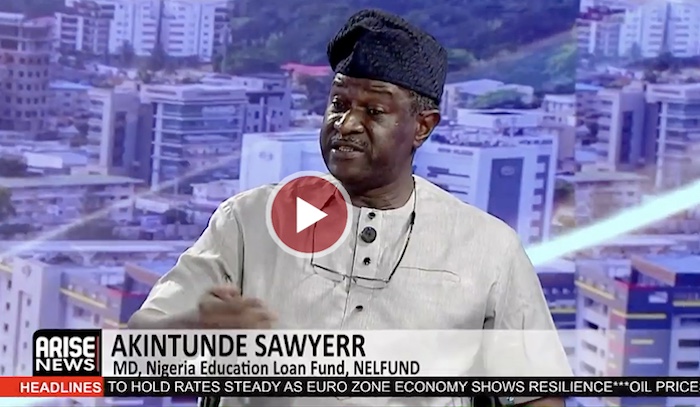

Managing Director of the Naira Education Loan Fund, NELFUND, Akintunde Sawyerr has stated that Nigeria’s student loan scheme is a temporary intervention designed to widen access to tertiary education amid limited resources adding that planned amendments will eventually extend benefits to all Nigerian students, including those in private institutions.

In an interview with ARISE NEWS on Thursday, Sawyerr said the current structure of the scheme reflects the country’s demographic realities, fiscal constraints and the urgent need to prioritise access to tertiary education for young Nigerians who lack the financial means to study. “So in this particular case, we have the complexity that we are a nation with a very high number of youths. So over 70 percent of our 230 million plus people are under the age of 35. We have a problem in that most of them are not either educated or not educated to the level that they would like to be, primarily because they don’t have the funds. It’s a resource issue.”

He explained that the law establishing the loan fund was designed to tackle two longstanding problems simultaneously: widening access to tertiary education and addressing the chronic underfunding of publicly owned universities. “The law is trying to fix a couple of things. First of all, trying to fix the fact that people who want to get education at tertiary level should be able to. They should be able to access it in an environment where resources are limited.

“The exclusion is a temporal thing in my view. I think once we’ve been able to cover those who really need it, then we’ll look at those. There are a couple of things going on. The private sector institutions tend to charge more. They tend to. Not in all cases. We also don’t have accurate information about the financial capacity of people, but we are using a little bit of a blunt instrument at the moment to say, look, people who are short of money tend to go to the public sector.”

According to him, public universities remain the primary destination for students from low-income households, making them the initial focus of the scheme. He acknowledged, however, that many middle-class families would prefer public universities but end up in private institutions due to limited admission spaces. “I don’t want to take anything away from those who have invested in private institutions, because they came to the rescue of education when we had issues over the years, strikes and neglect in the public sector. So the private investors have come in and they’ve tried to rescue education and they’ve done a great job.”

Sawyerr said President Bola Tinubu’s long-term vision was for all Nigerian students to benefit from the loan programme. “My discussions with His Excellency the President, whose vision it was to bring this to the fore, is that he would like to see all Nigerians get it. And I think that will happen when the resources are there. I think that we will have to go back and amend the law so that all can get it. The point is there is a political will to support every Nigerian having access to this loan.”

On concerns that the scheme could favour supporters of the ruling party, Sawyerr insisted the application process was politically neutral and fully automated. “So we have a portal and I will take the liberty of announcing that the address is www.nelf.gov.ng. It is totally agnostic. When you go to that portal, it doesn’t ask you whether you’re a member of a political party. It doesn’t ask you whether you’re a member of a particular tribe or a particular region. It does want to know what your gender is. It makes absolutely no difference. This is a national programme. It’s a national welfare seal that everybody can apply for. And there’s absolutely no way. We managed this. The Green Party won’t defect it.”

“The reality is that we have too many people in Nigeria chasing too few jobs. The jobs aren’t there. Where the jobs are, people aren’t qualified. They’re not educated enough or they’re not skilled enough. So you find organisations, companies going to bring foreign skills into the country. It’s totally unacceptable. One of the things we’re trying to address is the skills gap. By providing people with the ability to get an education that they want to get, that is required in the country, what we’re actually doing is making people more employed. Now, unfortunately, we don’t have a mandate to create jobs. But what we do have the mandate for is to give people the opportunity to be ready for jobs. And that we must focus on.”

He emphasised that the loans are interest-free and that repayment does not begin until two years after the completion of the National Youth Service Corps programme. “First of all, the loans that we’re giving are interest-free. So the students, the people who apply for these loans, don’t have to pay any interest on it. In a double-digit interest economy, that’s really very, very, very soft. The second thing is that they don’t have to start paying back until two years after the completion of their NYSC. So they graduate, they spend one year doing NYSC they get another year to look for work, the second year to look for work, and then in the third year, they’re eligible effectively. Or we can actually say, look, we would like you to start looking to pay back.

“We track the accounts of those who apply for the loans with us. If they move abroad, it’s pretty difficult for us to go and get those loans. We do expect a certain level of patriotism. Well, should that stop us? No. It’s not a slave contract. I can’t give you a loan and tell you not to go pursue an opportunity somewhere else. So we are caught in this area of people who will default, but so is everybody else who gives loans.”

Responding to allegations of corruption, Sawyerr said strict monitoring systems are in place to track every naira disbursed. “Look, wherever there’s money, you’re always going to get people who want to misappropriate, direct, misuse those funds. What we’re doing is we’re putting structures in place to ensure that we monitor every naira that comes in Nigeria Education Loan Fund, monitor to its destination, its intended destination, every naira that we disperse.”

He explained that tuition payments are made directly to tertiary institutions, while stipends go straight to students, leaving electronic trails. “But I can tell you we disperse to two primary targets. The tertiary educational institutions direct to their bank accounts, electronic footprint all the way, and we disperse to individual students the monthly stipend. Footprint all the way.

The ICPC is involved. The EFCC is involved. We don’t have powers of arrest. We’re cooperating with them. They’re asking us questions. We’re data. There have been some recoveries. There have been some detentions. I don’t think anyone’s been executed.”

On medical students, he said the fund currently lacks the resources to cover their higher tuition fees fully and is engaging institutions to avoid partial payments that could leave students stranded. “Again, it’s a resource issue. We don’t have enough to pay for medical students. I’m not going to pay for 60 medical students and deprive 600 people who are studying engineering somewhere else. It doesn’t make sense. So we’re having conversations with the institutions to say, look, let’s find a way.”

He acknowledged that students with disabilities face additional barriers beyond tuition and said the fund is exploring ways to provide broader support in the future. “So if you can say in one line, so we question around students with disabilities. It’s meant to be inclusive and you give loans to students with disabilities. However, there’s no support for their needs, their needs to access education. So it’s almost useless. What we’re trying to do is create an equal opportunities platform.”

Erizia Rubyjeana