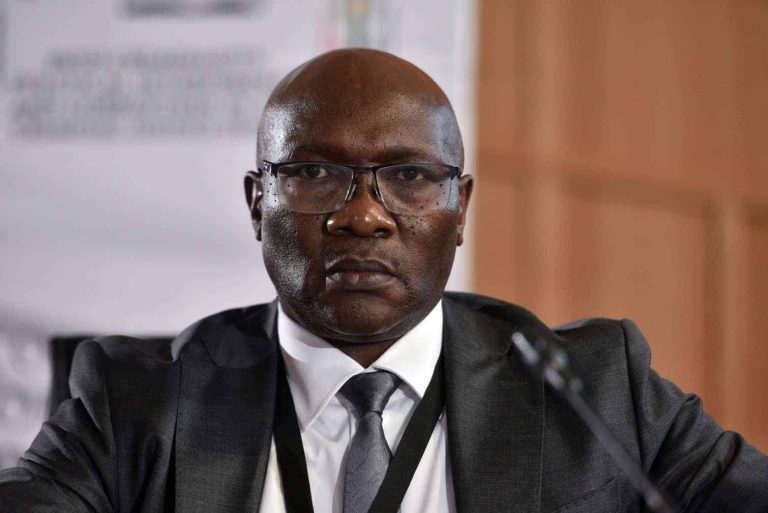

Economist and public affairs analyst, Professor Adi Bongo, has said that Nigeria’s political and economic problems are rooted in the country’s dependence on oil revenue rather than taxation.

Speaking during an interview on ARISE News on Thursday, Bongo argued that without a tax-based democracy, Nigerians cannot meaningfully hold their leaders accountable for the use of public funds.

“I keep saying that we’re not a tax-paying democracy. We are more like a revenue-sharing democracy. These are two different regimes and they create different incentives and also induce different sets of norms,” he said.

According to him, the system where governments rely on oil income rather than citizens’ taxes has created a culture of unaccountability and wasteful governance.

“If citizens don’t pay taxes, they don’t ask questions about how money is spent. That’s why leaders act without accountability,” Bongo stated.

He explained that taxation builds civic responsibility and gives citizens moral authority to question government actions. “Taxation gives citizens the moral right to question government spending. Without it, there’s no real democracy,” he said.

Professor Bongo further noted that Nigeria’s rentier economy sustained by oil revenue, has discouraged productivity and innovation across the country.

“The rentier system has made us lazy as a nation. Once money comes from oil, nobody bothers about productivity,” he added.

He warned that until Nigeria transitions into a tax-based economy, genuine reform and development will remain elusive. “Until we move from revenue-sharing to tax-paying democracy, genuine development will remain impossible,” Bongo said.

Calling for fiscal reforms at both federal and state levels, Bongo criticised the country’s over-centralised revenue system. “Every month, governors rush to Abuja for allocations instead of developing their internal economies. That’s our biggest problem,” he observed.

He urged Nigerians to demand a restructuring of the fiscal framework to promote accountability, transparency, and citizen participation. “If people begin to pay taxes directly, they will have the courage to challenge misuse of public funds,” he concluded.

Faridah Abdulkadiri